Digital currency pilots: On course, with potential to achieve something huge

The CBDC retail pilots are expanding in scope, participation and reach. Experts say that with the RBI's sustained push, it could emerge bigger than UPI in coming years

The CBDC or e-rupee is in the pilot stage for both wholesale and retail uses.

The CBDC or e-rupee is in the pilot stage for both wholesale and retail uses.

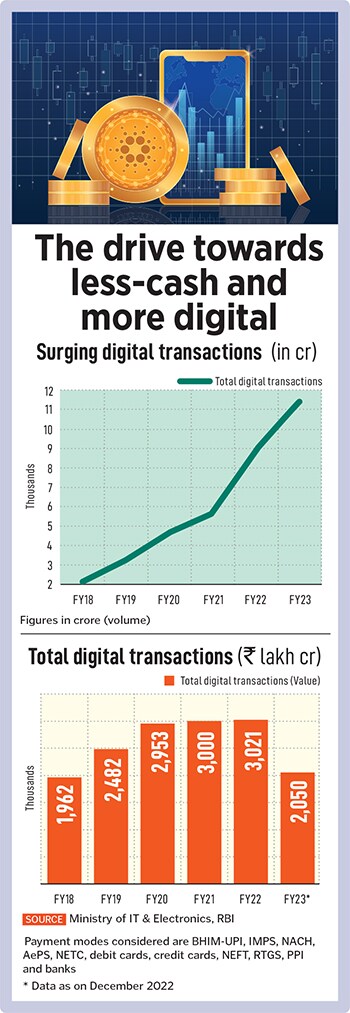

The Unified Payments Interface (UPI) could be considered the ‘Big Brother’ in India’s digital payments ecosystem; it commands over 75 percent of overall transactional volume in retail digital payments. But it is quite likely that the digital payments landscape could start to see changes by end-2023, with the Reserve Bank of India (RBI) expected to accelerate the presence and usage of the Central Bank Digital Currency (CBDC) nationwide by then.

The CBDC or e-rupee is in the pilot stage for both wholesale and retail uses. During the 12 months to March 2024, the RBI aims at “expanding the ongoing pilots in CBDC-Retail and CBDC-Wholesale by incorporating various use cases and features. The pilot in CBDC-Retail is proposed to be expanded to more locations and to include more participating banks,” it said in its annual report released in end-May.

Late to CBDC, but nothing lost

India came late to the CBDC party (see table), but that is because it already possesses a well-established and successful digital payments system in the form of UPI. In May, the RBI continued to add to the scope of the CBDC pilots, with more banks joining in. There are now 13 banks and 16 locations where CBDC is being made available. State Bank of India, HDFC Bank, Kotak Mahindra Bank, ICICI Bank, Axis Bank, Yes Bank and IDFC First Bank, besides others, have launched their digital rupee wallet.

In the case of merchants, several thousand across at least 50 centres, including the metros and several tier 2 cities, have been selected by the RBI to offer CBDC services. India’s largest retail chain, Reliance Retail, has already started accepting retail payments in digital rupee. “With more Indians willing to transact digitally, this initiative will help us provide yet another efficient and secure alternative payment method to customers at our stores,” V Subramaniam, director, Reliance Retail, said in a media statement in February.

In the case of merchants, several thousand across at least 50 centres, including the metros and several tier 2 cities, have been selected by the RBI to offer CBDC services. India’s largest retail chain, Reliance Retail, has already started accepting retail payments in digital rupee. “With more Indians willing to transact digitally, this initiative will help us provide yet another efficient and secure alternative payment method to customers at our stores,” V Subramaniam, director, Reliance Retail, said in a media statement in February.

Yes Bank’s head of digital banking and transformation, Ajay Rajan, says: “CBDC is a secure legal tender backed by RBI directly, hence it has the highest level of trust. It will be accepted as a medium of payment and a safe store of value by all citizens, enterprises, and government agencies. It is a convenient alternative to cash with underlying benefits of denomination selection and anonymity (under WIP as mentioned by the regulator).”

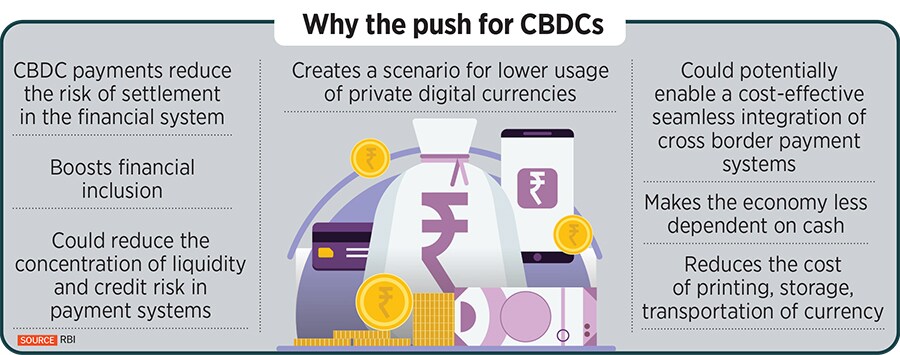

The RBI, in its concept note released prior to the pilots, said that it was simultaneously examining use cases that could be implemented with minimal or no disruption.

The RBI, in its concept note released prior to the pilots, said that it was simultaneously examining use cases that could be implemented with minimal or no disruption.