From incredulous to incredible: How OfBusiness turned into a profitable unicorn

In 2016, Asish Mohapatra's funding pitch got rejected 73 times. Five years later, his B2B commerce platform OfBusiness is valued over $1 billion

Asish Mohapatra, co-founder and CEO, OfBusiness

Asish Mohapatra, co-founder and CEO, OfBusiness

The funder’s journey as a founder started on an incredibly incredulous note. For Asish Mohapatra—who was a venture capitalist with Matrix Partners India for five years before he turned entrepreneur by co-founding OfBusiness in 2015—his frequent tryst with episodes of disbelief started quite early. The first, and the biggest, was that having a VC background is of little help. “Being a VC,” reckons the co-founder and chief executive officer of OfBusiness, “is no advantage at all.” Mohapatra explains. In 2016, the investor pitch of the former ITC and McKinsey executive got repeatedly rejected for a staggering 73 times in a span of just six months. “Isn’t that incredible and incredulous,” he asks.

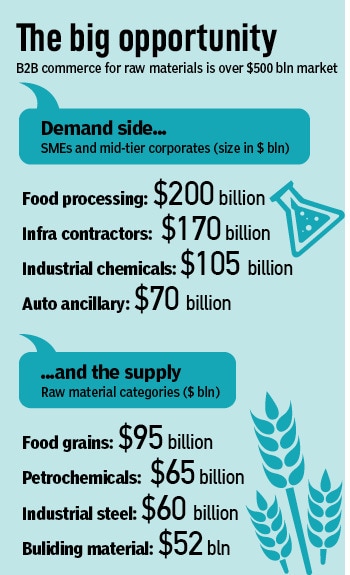

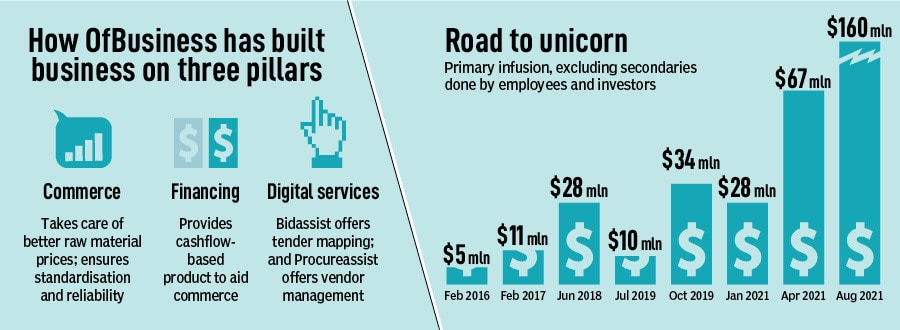

In mid-2016, just a year into his B2B ecommerce venture which provided full-stack solution spanning raw material procurement, working capital financing and revenue growth opportunities in a bunch of sectors, including manufacturing and infrastructure, Mohapatra found it difficult to sell his story to the VCs. There were four big questions hurled at the first-time entrepreneur. The first one happened to be the easiest one: Is there a precedent? Has anybody done it in the US or China? OfBusiness, he proudly explained, was to the first one to bring two sets of business engines together: Commerce and financing. The potential backers were not impressed. “They just didn’t believe,” he recalls.

The second question carried some heft. None of the five co-founders had any credit background. “So how will you do the financing,” was the query. Mohapatra knew what was coming. “I will go through the balance sheet, learn the skill and do it,” was his reply. Despite the fact that the gritty founder studied books of over 1,000 companies didn’t cut much ice. “They again didn’t believe that we could do,” he recounts, adding that he was the first underwriter—credit guy—in OfBusiness.

The third question seemed logical. Both commerce and financing were difficult businesses. “You are bringing them together. So now it becomes doubly tough. How will you do it.” Mohapatra smiled and dished out a disarming reply. “If it is difficult, it has money. And if it is doubly difficult, it has more money,” he answered. The response didn’t evoke any retort. “My business was something that nobody understood,” he rued.

The third question seemed logical. Both commerce and financing were difficult businesses. “You are bringing them together. So now it becomes doubly tough. How will you do it.” Mohapatra smiled and dished out a disarming reply. “If it is difficult, it has money. And if it is doubly difficult, it has more money,” he answered. The response didn’t evoke any retort. “My business was something that nobody understood,” he rued.

The last question was the smartest one. “Can commerce and finance remain in tandem for long?” Mohapatra was happy with the quality of the question. Over a period of time, he explained, the businesses would be separate. “Still, nobody believed,” he quipped.

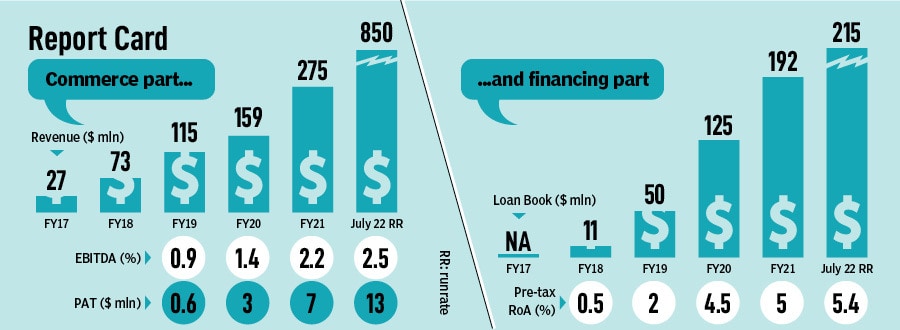

For the freshly-minted unicorn, the incredible part is that unlike most other companies in the

For the freshly-minted unicorn, the incredible part is that unlike most other companies in the

Another unique thing about OfBusiness is the way it does business: Around 70-80 percent of the staff are freshers. “There’s nobody senior from the industry, except the 4-5 people who we started with,” Mohapatra says. Reason: It is easier to make a person learn than to make him unlearn. Except technical functions like engineering and underwriting, all functions in the company are filled with freshers or the ones with less than a year of experience. The modus operandi to hunt talent is equally distinctive. Except all so-called top-rated IIMs, the startup visits the lesser-known cousins. “We sell a dream on the campus saying that ‘boss char saal main business head banna hai to aaa (if you want to become business head in four years then join us),” he says.

Another unique thing about OfBusiness is the way it does business: Around 70-80 percent of the staff are freshers. “There’s nobody senior from the industry, except the 4-5 people who we started with,” Mohapatra says. Reason: It is easier to make a person learn than to make him unlearn. Except technical functions like engineering and underwriting, all functions in the company are filled with freshers or the ones with less than a year of experience. The modus operandi to hunt talent is equally distinctive. Except all so-called top-rated IIMs, the startup visits the lesser-known cousins. “We sell a dream on the campus saying that ‘boss char saal main business head banna hai to aaa (if you want to become business head in four years then join us),” he says.