How Powergrid is catching up with the renewable energy transition in India

In his first exclusive interview since taking over the largest electric power transmission utility in the country, RK Tyagi discusses the high-stakes projects under the Power Grid Corporation of India, and why the future of transmission will have India looking both inwards and at faraway lands

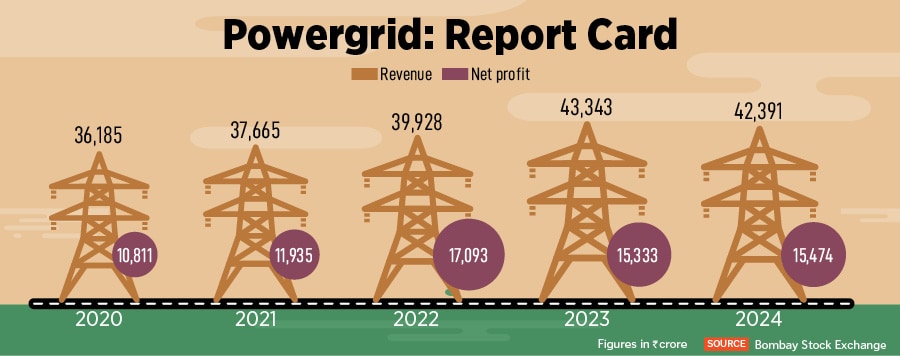

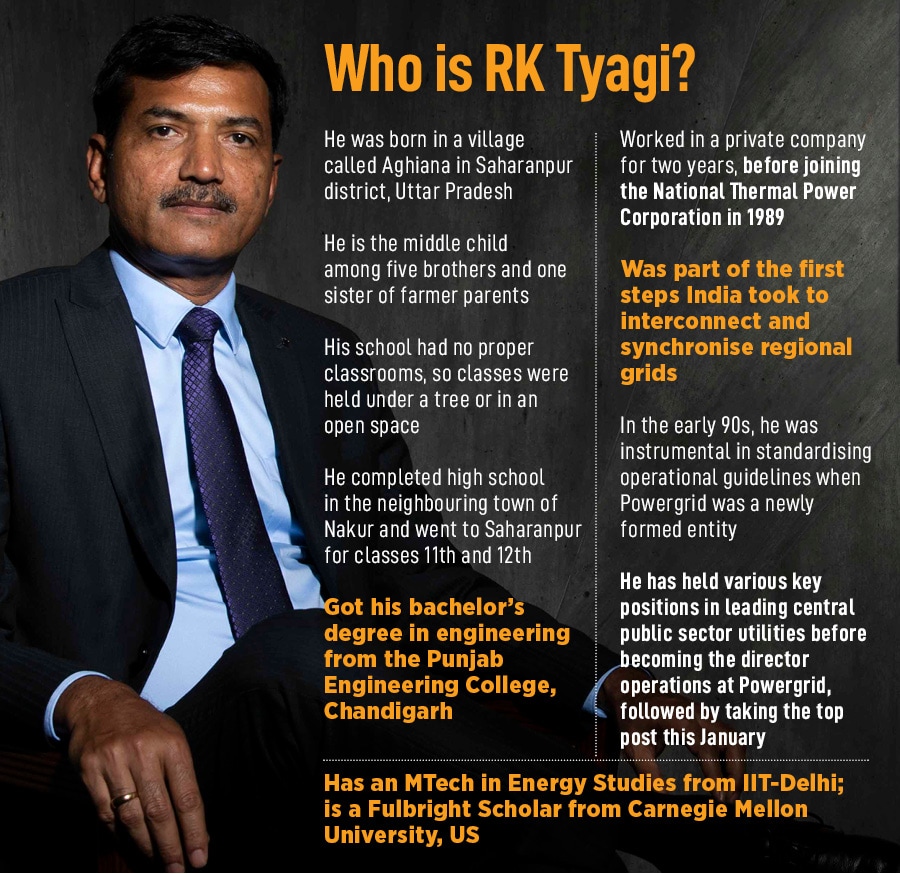

Ravindra Kumar Tyagi, chairperson and managing director, Powergrid. Image: Amit VermaIn January, Ravindra Kumar Tyagi took over as the chairperson and managing director (CMD) of the Power Grid Corporation of India (Powergrid), a public sector enterprise that is the backbone of the country’s electric grid. We are sitting in Tyagi’s office in Delhi a few weeks after the company announced a soft business quarter ending June 2024. Income was at Rs11,280 crore, from Rs11,258 crore the same quarter the preceding year, and profit after tax was at Rs3,724 crore in Q1FY25, up from Rs3,597 crore in the June-ended quarter the previous year. The expected topline increase in FY25 is four to five percent, and capex is an estimated Rs18,000 crore.

Ravindra Kumar Tyagi, chairperson and managing director, Powergrid. Image: Amit VermaIn January, Ravindra Kumar Tyagi took over as the chairperson and managing director (CMD) of the Power Grid Corporation of India (Powergrid), a public sector enterprise that is the backbone of the country’s electric grid. We are sitting in Tyagi’s office in Delhi a few weeks after the company announced a soft business quarter ending June 2024. Income was at Rs11,280 crore, from Rs11,258 crore the same quarter the preceding year, and profit after tax was at Rs3,724 crore in Q1FY25, up from Rs3,597 crore in the June-ended quarter the previous year. The expected topline increase in FY25 is four to five percent, and capex is an estimated Rs18,000 crore. Tyagi, who had started working in the transmission sector in 1989, is confident of the long-term growth prospects of the company, given that India is at a crucial juncture in energy transition, where the role of transmission companies will only become more crucial in the years to come.

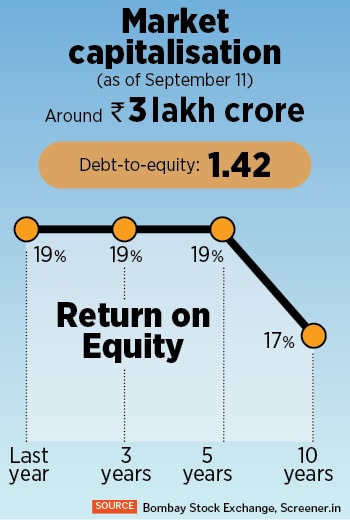

Powergrid, Tyagi says in his first exclusive interaction since becoming CMD, will become a Rs5 lakh crore company in six to seven years. Currently, its market capitalisation stands at around Rs3 lakh crore. “We have projects worth more than Rs100,000 crore that are yet to be commissioned, and another Rs1 lakh crore projects are in the tendering pipeline under the tariff-based competitive bidding process,” he says.

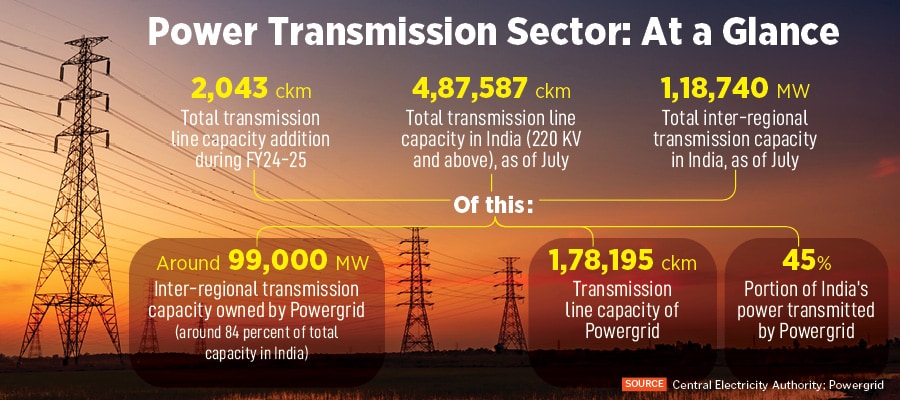

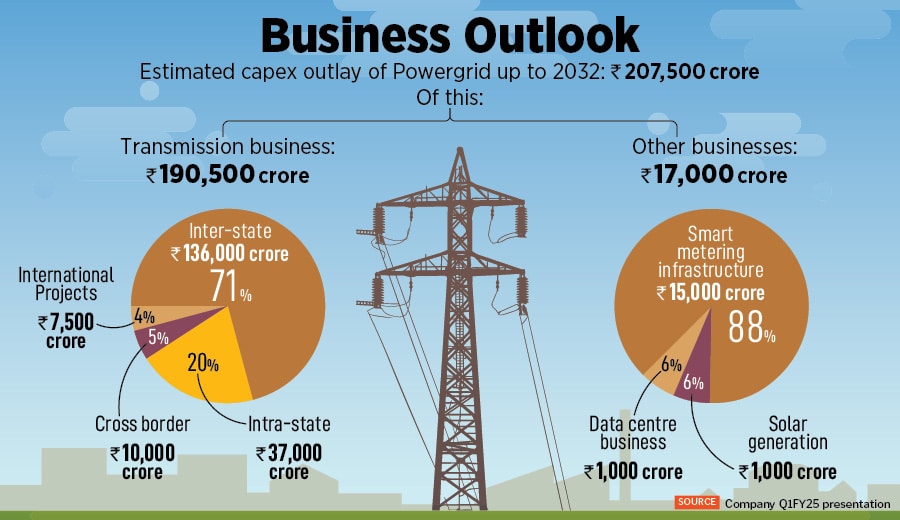

The public sector utility, which transmits 45 percent of India’s power and controls around 84 percent of the inter-regional transmission capacity in the country, added 91 ckm transmission lines during the quarter ended June, as per the company’s investor presentation in June. It announced an estimated capital expenditure outlay of Rs207,500 crore up to 2032, out of which Rs190,500 crore will go to the transmission business, and around Rs17,000 crore to solar generation, smart metering infrastructure and data centres.

The next few years will likely be an uphill climb for the Maharatna company, given the existing realities and challenges in India’s energy sector. The country has made significant progress in renewable energy (RE) capacity generation, adding close to 150 gigawatt (GW) in capacity over the last decade, a bulk of it in solar and wind energy. The target is to have 500 GW of non-fossil fuel capacity in the next six years, which means at least 50 GW additional capacity every year until 2030.

One of the biggest challenges with renewable energy is that it is intermittent, which means that it is unavailable at all times. Second, the large swathes of land in which wind and solar energy is generated tend to be far from the cities or regions consuming that electricity.

There is also the difference in pace between generation and transmission of projects. RE generation takes only about six to eight months, but building a transmission network takes at least two to three years, says Tyagi, who is an engineer by qualification. “We are taking action in advance to ensure not a single megawatt (MW) of renewable energy generation is stuck up anywhere,” he says. “The target [500 GW by 2030] of the Government of India is huge, and accordingly transmission network is required before generation happens. It’s a really big challenge, but we have to handle it with the help of each other.”

“RE generation capacity comes faster than transmission. Any delay in transmission, and generation languishes because of lack of connectivity, and energy transition gets affected. So, transmission is critically important, but somehow not talked about as much as it should be,” says Indu Shekhar Chaturvedi, director general, Electric Power Transmission Association.

The conventional transmission system, which relied largely on fossil fuels and involved regional generation and consumption of power, has been changing for a couple of reasons, both in India and internationally. “Absorbing variable renewable energy from smaller, decentralised grids is an issue. Having that single interconnected national grid is a major boost for the country,” says Anujesh Dwivedi, partner, Deloitte India, who leads power and utilities. He adds that some of the large countries of the world with comparable power systems in terms of size do not have a unified national grid.

India is facing concerns around peak demand as it navigates energy transition. “Hence, you can see investments in transmission systems for green energy corridors in India, which will integrate renewable energy into the country’s power grid,” Dwivedi says, adding that world over, the electric grid is attracting investments in trillions of dollars—in the US, Europe, UK and Canada. “I don’t think the 500 GW goal will be possible without massive commensurate investments in the grid, so we should expect more investments in the grid going forward.”Also read: How are India's power companies handling the crucial renewables transition?

The Opportunity

Among the developments that can give the transmission industry—and Powergrid—a boost is what can be the world’s highest-voltage 1,200 KV transmission network. At present, China has the 1,100 KV direct-current Changi-to-Guquan transmission network.So far, India transmits power mainly on 400 KV and 765 KV AC (alternating current) lines, which can transfer 2000 MW of power in AC links, and the 500 KV and 800 KV HVDC (high-voltage direct current) lines, which can transfer about 6,000 MW in DC links. The 1,200 KV line, which has been in the works for some time now, can carry up to 8,000 MW of power.

For the 1,200 KV line, Powergrid established a test station in Bina, Madhya Pradesh, in 2016, and about 349 km-long transmission line between Wardha and Aurangabad in Maharashtra. “But the 1,200 KV network was not developed because we were developing the 765 KV network across India. The 1,200 KV line is still under discussion with the government, and soon you might hear of this being developed as well,” Tyagi says, adding that a 1,200 KV line, when fully developed, will be critical in carrying the large power quantum India has targeted to develop in the future.

For the 1,200 KV line, Powergrid established a test station in Bina, Madhya Pradesh, in 2016, and about 349 km-long transmission line between Wardha and Aurangabad in Maharashtra. “But the 1,200 KV network was not developed because we were developing the 765 KV network across India. The 1,200 KV line is still under discussion with the government, and soon you might hear of this being developed as well,” Tyagi says, adding that a 1,200 KV line, when fully developed, will be critical in carrying the large power quantum India has targeted to develop in the future. Another business growth driver is international interconnections. He says that integrating with power sources from faraway lands will be crucial for efficient energy transmission in India in the future. In a media interaction in Mumbai on July 29, he had said that Powergrid is part of the taskforce for the One Sun One World One Grid initiative, under which the Government of India is exploring energy interconnections projects with Oman, Saudi Arabia and the United Arab Emirates (UAE).

The size of these projects will be around 2,000-5,000 MW, subject to finalisations by the Government of India and governments of the respective countries in the Middle East. It is estimated to be valued over Rs40,000 crore, and executed over the next six to seven years, subject to various approvals. This will require an undersea interconnection link, which will be a first-of-its-kind for India. In September 2023, India and Saudi Arabia had signed a memorandum of understanding (MoU) for grid interconnection, and in October, inked an MoU for sharing electricity during peak demand and emergencies.

“We are equipped to undertake transmission on land, but undersea and submarine transmission will require setting up a supply chain for undersea cable in India,” Tyagi tells Forbes India, adding that the company has been in talks with IIT-Madras and other experts for making offshore pooling stations (to leverage offshore wind energy) and deploying undersea cables. They are also exploring technology and knowledge transfers from the West, where undersea projects have been executed.

As per the company’s business outlook up to 2032, out of the estimated Rs190,500 crore outlay for the transmission business, international interconnections will account for 4 percent, around Rs7,500 crore, while cross-border projects will account for 5 percent, around Rs10,000 crore. Currently, Powergrid has cross-border interconnections of around 4,750 MW with countries, including Nepal, Bhutan and Bangladesh. Discussions are underway with Sri Lanka.

“Interconnections with some of our neighbouring hydro-rich countries like Nepal and Bhutan will help us balance renewable energy requirements through the power that is sourced into India from these regions,” says Dwivedi of Deloitte India.

World over, examples of international interconnection projects include a 764-km power line from the UK to Denmark, the world’s longest land-and-subsea grid connection, launched in December, as per a June article in the Wall Street Journal (WSJ). Singapore wants to import 30 percent of its electricity by 2035, and last year, granted conditional approval on plans to import much of that electricity via subsea cables from renewable energy projects in Indonesia, Cambodia and Vietnam. There’s another mega project underway in which a 4,023 km subsea power line would connect wind and solar farms in Morocco to the UK. Such projects, as per the WSJ article, can take well over a decade to materialise.

Delays and Challenges

A bulk of Powergrid’s business revenue will continue to come from inter-state connections (see box). “Long before private sector was allowed in the transmission business, Powergrid had a monopoly of inter-state transmission. Even today, although there is competition from the private sector, we expect it to remain the largest contributor to inter-state power transmission,” says Sabyasachi Majumdar, senior director, CareEdge Ratings.Also read: What Budget 2024-25 says about India's energy security and transition roadmap

As of the quarter ended June 2024, Powergrid has work-in-hand worth Rs114,139 crore, out of which Rs10,318 crore is ongoing RTM projects, Rs37,010 crore is new RTM projects, while Rs66,811 crore is other projects, including TBCB. In its FY25 capex plan of Rs18,000 crore, around Rs5,000 crore is coming from RTM projects, while Rs13,000 crore is from other projects, including TBCB.

“Going forward, because there are efforts to get more projects under competitive bidding, in case Powergrid wins the bid and it is not able to complete the projects within the stipulated budget, it could impact their returns,” says Majumdar of CareEdge. “Completing projects without much delay and cost overhaul will be critical and that will be the main challenge going forward.”

Growth in renewables capacity is being “severely hit” by power transmission delays on account of hurdles like Right Of Way issues, opposition from landholders, compensation disputes, delays in obtaining forest, wildlife and tree-cutting approvals, says a September 9 article by Mercom, a clean energy research and consultancy firm. Right of way refers to a strip of land that a utility needs to build, maintain and protect a transmission line.

“Transmission projects typically have longer gestation periods than renewable energy projects, but delays due to implementation challenges on the ground have stretched timelines for up to 24 months to over five years in some cases,” says the article, quoting July 2024 data from the Central Electricity Authority.

Tyagi agrees that minimising delays is challenging. They face land scarcity, and procuring land for a project can take at least a year. So, they plan in advance. “As soon as we get details of a project, our team starts talking and negotiating directly with landowners. So, by the time we win a project, getting the land is almost in the final stages,” he says.

The Ministry of Power in June issued new guidelines regarding Right of Way compensation for transmission lines to streamline transmission line construction and completion of projects without much delay. According to the guidelines, the district collector, district magistrate or deputy commissioner will determine the compensation. Tyagi says the guidelines will go a long way in addressing a huge business challenge, provided states implement it soon, giving district magistrates or collectors the authority to determine compensation.Also read: There is opportunity to create more jobs in the green energy economy: World Economic Forum's Espen Mehlum

Adopting technology and design interventions is also necessary to implement large transmission projects, says Tyagi. At an industry level, some technologies could include multi-circuit and multi-voltage towers, compact towers with insulated cross-arms, steel pole structures, emergency restoration systems, and monopoles (one main pole anchored to the ground makes up the entire structure).

Powergrid has signed an MoU with the Indian Space Research Organisation for data sharing in order to manage their transmission towers with the help of a geospatial dashboard and tools for disaster analysis and vegetation monitoring. They have developed a robot with IIT-Kanpur for automatic inspection of substations, which recently carried out a trial run, and they also leverage artificial intelligence and machine learning for improving operational efficiency.