Into the unknown: Why the future of India's crypto ecosystem looks blurred

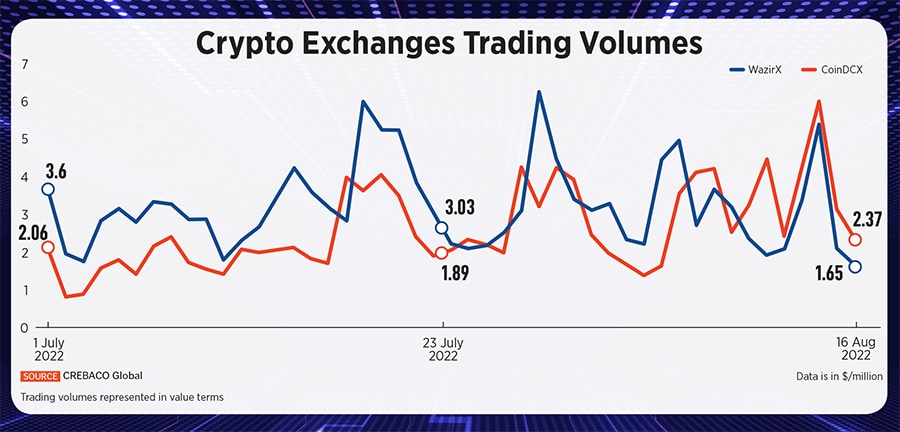

The WazirX controversy has jolted the Indian crypto industry. As trading volumes shrink, crypto exchanges are exploring investment routes, but with a stifling tax regime, the picture doesn't look rosy for the sector

Trading activity is a function of market sentiment; in a bear market, investors will not buy bitcoin at depressed levels

Illustration: Chaitanaya Dinesh Surpur

Trading activity is a function of market sentiment; in a bear market, investors will not buy bitcoin at depressed levels

Illustration: Chaitanaya Dinesh Surpur

Is this current market phase a short, summery day in a still-bleak crypto winter? Equity markets across the globe have staged a bit of a recovery—after a depressing first half-year—on the hope that global inflation will start to ease off and that it may not completely derail growth across economies. Consumer spending in some countries is also starting to improve.

However, for a crypto retail investor, particularly in India—where a stifling tax structure makes investing and trading a financial hazard—a rise in bitcoin and ethereum prices from their June lows might not be good news yet. The risk averseness is real.

The WazirX parentage puzzle

For investors, jolts have continued uninterrupted in July and August. In mid-July the Internet and Mobile Association of India (IAMAI) said it was shutting down the Blockchain and Crypto Assets Council (BACC) due to a “still very uncertain” resolution of the regulatory environment for the industry. The IAMAI will now focus on promoting the proposed Central Bank issued Digital Currency (CBDC).In August, WazirX, India’s premier crypto exchange by trading volumes, got embroiled into a controversy over its ownership with global crypto exchange Binance. A regulatory spotlight was on WazirX, and this, possibly, led to a public spat between Binance’s CEO Changpeng Zhao (popularly called CZ) and WazirX’s co-founder Nischal Shetty on Twitter.

The controversy erupted after the Enforcement Directorate (ED) had issued a show cause notice to WazirX on charges of violations of the Foreign Exchange Management Act (FEMA). On August 5, the agency announced that it had raided the properties of Sameer Mhatre, a WazirX director, and also frozen some of WazirX’s bank accounts for Rs64.7 crore. This was reportedly part of the ED’s investigation into several Chinese loan apps operating in India.