Pizza, Kapda & Makaan : How Domino's is Making a Play for Bharat

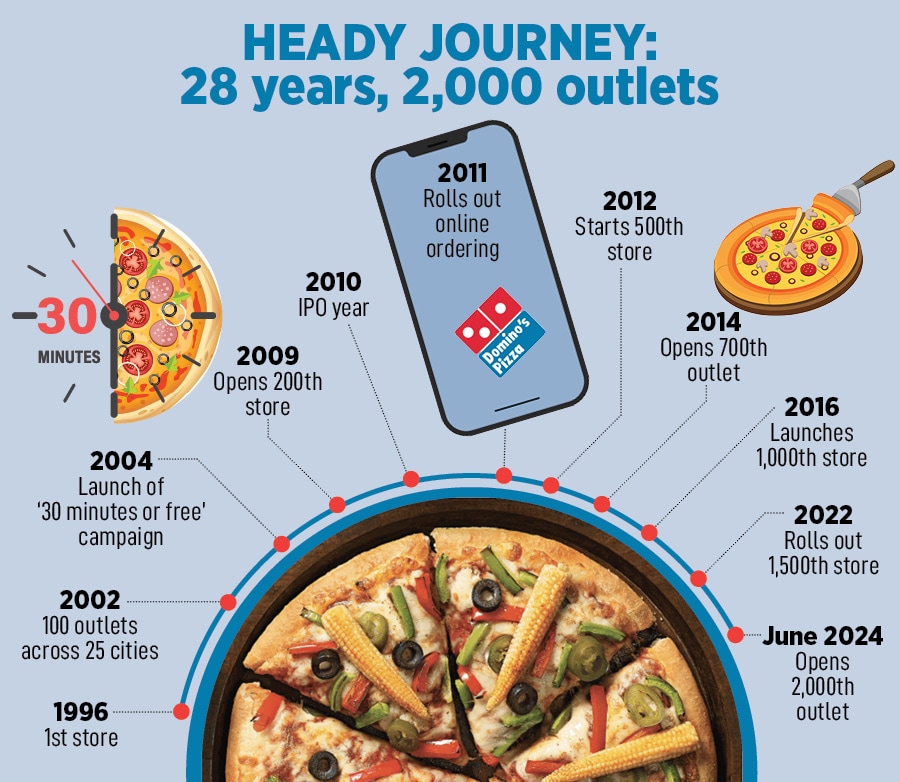

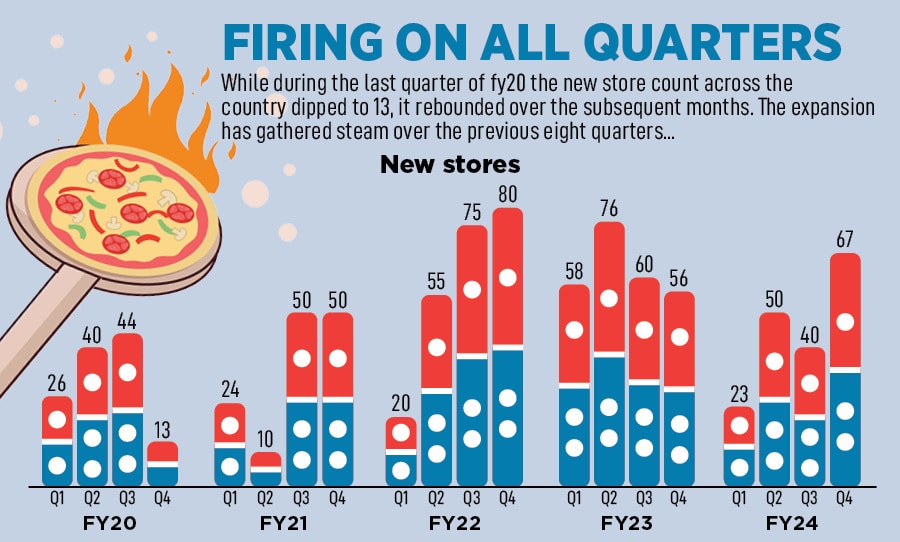

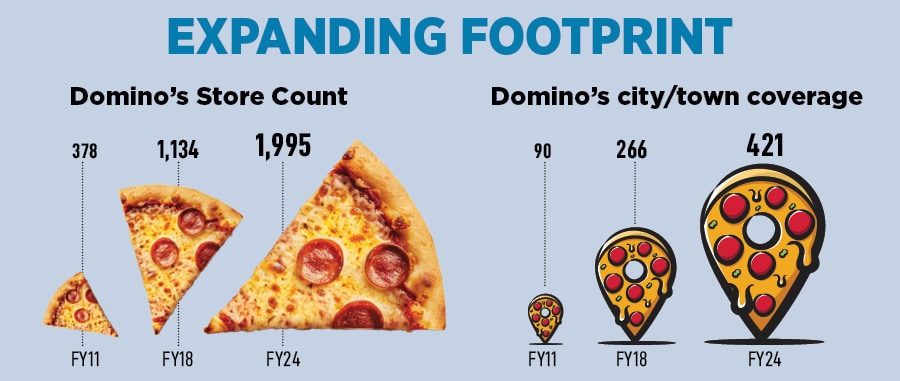

Over the last two years, Domino's has been making a concerted bid to go deeper into the hinterland. With the next growth phase slated to come from tier III, IV, and beyond, can Bharat's hunger pangs deliver results for India's biggest QSR player, which recently rolled out its 2,000th outlet in Delhi-NCR?

Manoj Sisodia treats his nephew Honey Rawal to a quick pizza at Domino's Dadri Image: Madhu Kapparath

Manoj Sisodia treats his nephew Honey Rawal to a quick pizza at Domino's Dadri Image: Madhu Kapparath

Manish Kumar Sharan shares a slice of life story. “There are only two reasons why people buy Nikey,” reckons the 50-year-old businessman who runs a pharma store in Dehri-on-Sone, a small town on the banks of Sone river in Bihar. One buys a knockoff, he explains, if one can’t pay for an original brand. “If you don’t have money to buy Nike, you will buy Nikey,” smiles the pharmacist, who used to whizz along some 140 km on his Pulsar bike to buy branded products for his family, as well as satiate his pizza pangs in the state capital of Patna.

Some 1,000 km from Dehri is Dadri, another small town in the Gautam Buddha Nagar District of Uttar Pradesh. Manoj Sisodia is performing his weekend ritual of taking his young nephew to a Domino’s outlet. “My family stays in a village which is some 6 km from this place,” says Sisodia, a civil engineer in Noida who visits his family every weekend. The recently opened Domino’s outlet is sandwiched between an HDFC bank and a homoeopathic clinic. There is a two-wheeler repair centre just next to the pizza outlet, and one can spot tractors frequently rolling down the road. “Pizza gives the kids a break from roti during the weekends,” smiles Sisodia, who has fallen in love with cheese-stuffed garlic bread.

Around an hour away, at the glitzy corporate headquarters of Domino’s in Sector 98, Noida, Sameer Khetarpal tells us why the biggest pizza brand in India has fallen in love with smaller towns. “Tier III, IV and beyond is a massive opportunity for Domino’s,” says the managing director and CEO of Jubilant FoodWorks, the master franchise of Domino’s in India and a clutch of global markets such as Bangladesh, Nepal and Sri Lanka. “The consumption, income, and celebration of people at such places are similar to their counterparts in top and tier I cities,” underlines Khetarpal, who joined Jubilant FoodWorks in September 2022.

View of Domino's in Dadri, a small town in the Gautam Buddha Nagar District of Uttar Pradesh Image: Madhu Kapparath

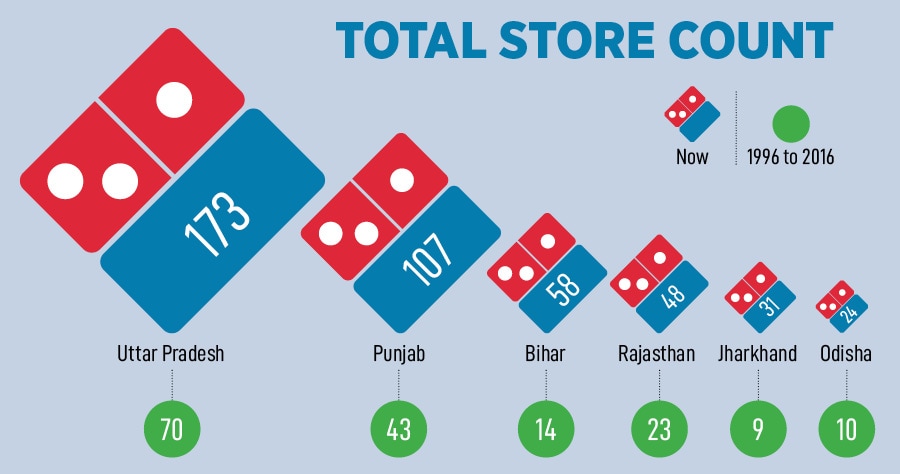

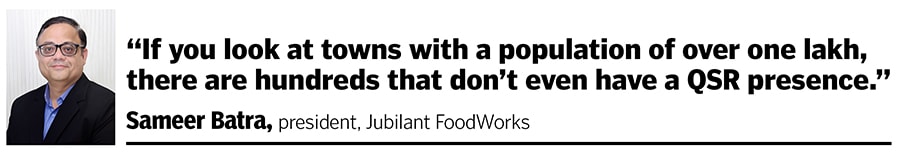

View of Domino's in Dadri, a small town in the Gautam Buddha Nagar District of Uttar Pradesh Image: Madhu Kapparath The top boss from Amazon tells us why QSR is set to explode across the hinterlands. First, Bharat is not exposed to QSR culture and experience. “They want an experience that is world-class, and they know there is no fear of being judged,” he says. Sameer Batra, Khetarpal’s colleague and president of Jubilant FoodWorks, dishes out data to add heft to the CEO’s point. “If you look at India in terms of towns with over a lakh population, hundreds don't even have a QSR presence,” he reckons, adding that KFC has over 10,000 outlets in China. “We want to be the first QSR chain to enter in the next 800 – 1,000 towns and cities across India,” says Batra, adding that Domino’s recently opened its 2,000th outlet in Delhi-NCR. “There is an opportunity to take pizza deeper,” he adds.

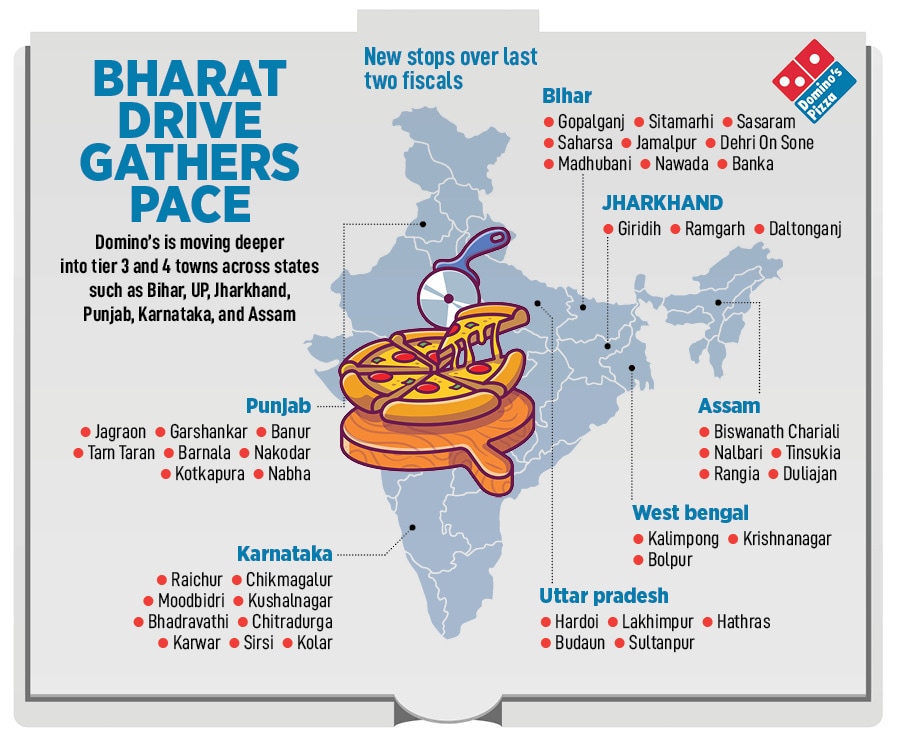

No wonder, Domino’s has been on a Bharat overdrive. Look at the places the pizza brand has ventured into over the last two fiscals. From Gopalganj, Sitamarhi, Sasaram, and Dehri On Sone in Bihar to Hardoi, Lakhimpur, Hathras, Budaun, and Sultanpur in Uttar Pradesh, and Giridih, Ramgarh, Daltonganj in Jharkhand, the brand has been fanning across tier III and beyond in search of consumers, growth and money (see box).

What is also pushing the big hinterland drive is a growing realisation that Domino’s must look beyond delivery. “We have to focus on dine-in otherwise we will become a dark store brand in 10 years,” says Khetarpal, adding that while dine-in contributes over 30 percent of sales in cities, the number gets closer to 50 percent across tier III and beyond. The brand zeroed in on some 150 stores for a fresh makeover, and the results are positive. “We see 8 percent to 12 percent growth in the stores that have been reimagined,” he claims. While acknowledging that there is pressure on dine-in in top cities, it remains a significant channel for recruiting more customers. “The first purchase of all the stickiest customers in our portfolio was on dine-in,” he says.

Also read: KFC, Pizza Hut, and Costa Coffee: Ravi Jaipuria's Devyani International and its insatiable appetite for growth

A Family at Domino's pizza outlet in Dadri, GB Nagar district, Uttar Pradesh

Image: Madhu Kapparath

A Family at Domino's pizza outlet in Dadri, GB Nagar district, Uttar Pradesh

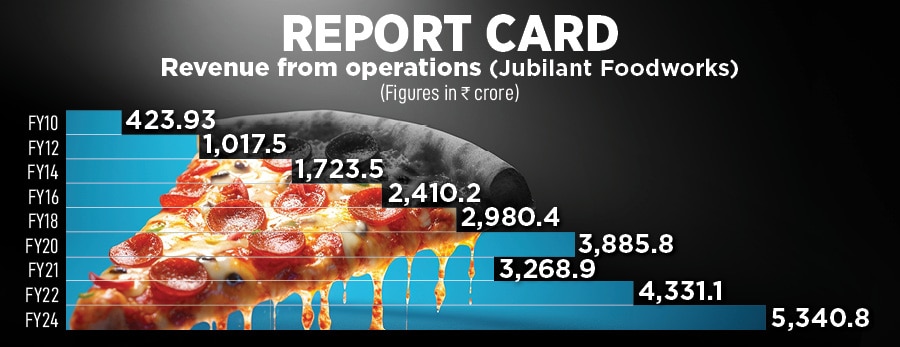

Image: Madhu KapparathKhetarpal explains why dine-in is critical for a brand that has mastered the art of delivery. “In the food business, you have to experience. Therefore, dine-in becomes important, seeing the brand becomes important,” he says. If one is producing 10 brands and cuisines in a dark kitchen, not many customers would appreciate it. “Globally, I am yet to come across a dark store model that has scaled,” he says, adding that it’s not easy to scale the dine-in, and food business in India. “Over the last three decades, there have been only three brands in India that have crossed Rs 1,000 crore in revenue and 10 percent of EBITDA: Domino’s, KFC and McDonald’s,” says Khetarpal. “The rest have struggled,” he adds.

Another factor aiding the brand’s aggressive expansion is its pecking order, and a stark market reality. The Indian food service market is estimated to be $50 billion. “Pizza is just $1 billion,” says Khetarpal. A vocal proponent of category expansion, the CEO reckons that Domino’s can’t be complacent in a $1-billion category and with over 70 percent market share in pizzas. “That's not the game we are playing. We have to grow the category,” he says. Moving deeper into the hinterland is geared towards growing the category and ramping up sales.

Brand and marketing experts give a thumbs-up to the strategic move to venture across tier III and beyond. “I have always maintained that pizza is the new roti,” says Harish Bijoor, who runs an eponymous brand consulting firm. Pizzas, he underlines, have a much better chance of making it big in India. “Pizza is a roti topped with vegetables, cheese and chicken. Pizza is the splurge item in smaller towns,” he says, adding that offering stuff to people who don’t have enough is always the better option than opening more stores in cities where people are already spoilt for choice. The country, he explains, can be classified into various categories in terms of socio-economic growth: Urban, rurban, rural and deep rural. “Deep rural is where the prosperity lies today. They have money, aspirations and hunger to consume,” he adds.

Back at Sector 98 in Noida, Khetarpal talks about the big challenges for Domino’s. One of them is sticking to the proposition of offering value for money. “If you have to win against vada pav, idli and samosas, then Domino’s has to be present at an affordable price point,” he says, adding that Domino’s recently rolled out pizza for Rs 49. The response, he claims, is encouraging. The challenge is also to expand the product offerings. For instance, Domino’s recently rolled out oregano-rice bowls in the Bangladesh market. “We are launching it in India as well,” he says.

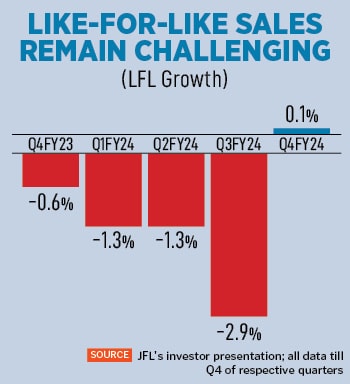

An aggressive Bharat push, though, is set to throw a new set of formidable challenges for the brand. “The more stores they open, the more they have to ensure that the same-store sales don’t decline,” a QSR veteran and food analyst sounds a word of caution. There is another catch-22 situation. As they open more stores in top cities to execute a 20-minute delivery, they have to contend with a sea of homegrown pizza brands nibbling at their market share. “It’s a tough balancing act,” he says, requesting anonymity.

Khetarpal, for his part, reckons that the brand is not spreading itself too thin. “We are doubling down on Domino's. There is a massive headroom for growth,” he signs off.