Rate hike: Not a question of 'if' but 'how much'

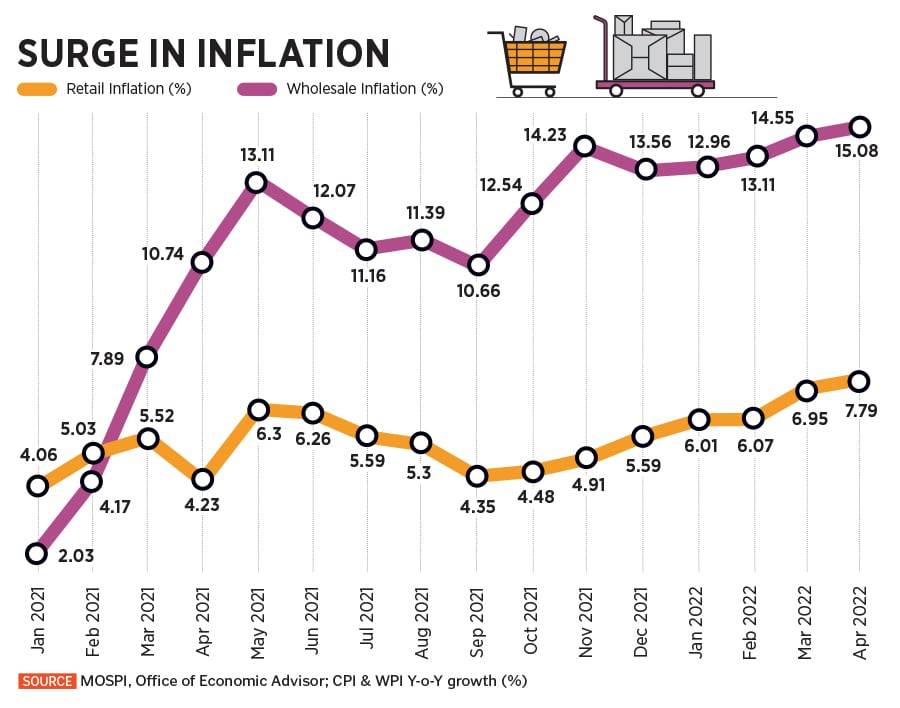

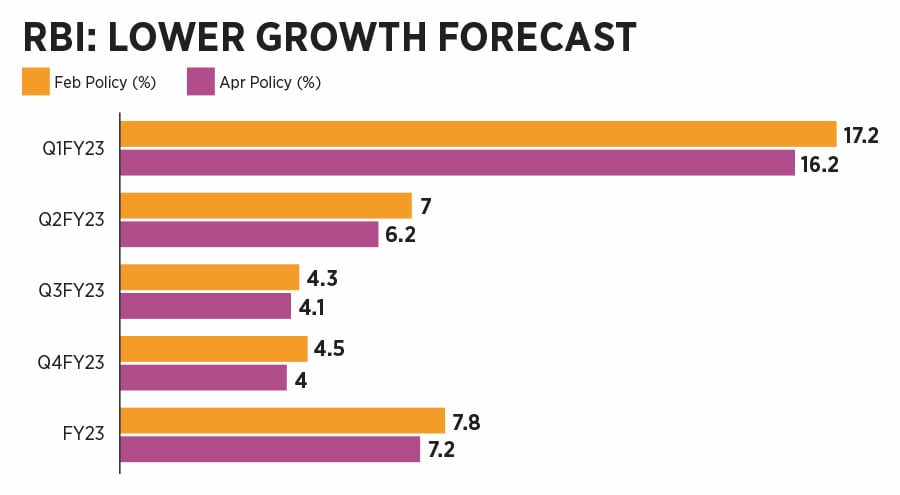

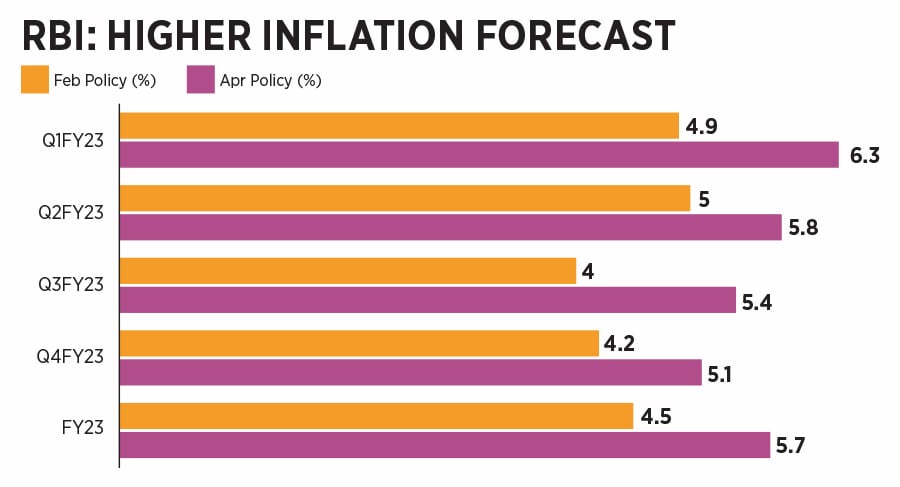

Amid surging inflation and global volatility, the Reserve Bank's rate setting panel will begin its bi-monthly monetary policy deliberations on June 6 and is widely expected to hike rates as it renews its focus on inflation control over growth

An ultra-accommodative monetary policy was crucial to cushion the severe impact of the unprecedented coronavirus pandemic. Nonetheless, like most global central banks, the RBI has been slow in its withdrawal of liquidity

Image: Punit Paranjpe

An ultra-accommodative monetary policy was crucial to cushion the severe impact of the unprecedented coronavirus pandemic. Nonetheless, like most global central banks, the RBI has been slow in its withdrawal of liquidity

Image: Punit Paranjpe

The Reserve Bank’s Monetary Policy Committee (MPC) will meet next week to mull interest rates and unveil the bi-monthly credit policy on June 8. The rate-setting panel huddled in an off-cycle meeting last month to take steps to tackle rapid inflation with a hike of 40 basis points in the benchmark repo rate while remaining accommodative.

Ahead of the meeting on Monday, the chatter in business circles is not whether or not there will be an increase in interest rates. Rather, the question on everyone’s lips is if the repo rate will be raised by 35 bps, 40 bps, or 50 bps. After all, in the words of RBI Governor Shaktikanta Das, the expectation of a rate hike is a no-brainer.

Financial markets have pencilled in a rate hike of up to 50 basis points next week. A Reuters poll, done between May 26 and June 1, suggests that the central bank is likely to raise the repo rate by at least a 100 basis points over the next four MPC meetings. A majority of the respondents polled predicted the repo rate was likely to inch up to at least its pre-pandemic level of 5.15 percent next quarter. Many of the poll participants see the repo rate perched at 5.5 percent at the end of the year.

Pankaj Pathak, fund manager-fixed income, Quantum AMC, expects a repo rate hike of 35-40 basis points next week. However, on the back of the Centre’s recent announcement of fuel tax cuts and reduction of import duties on edible oils, Pathak says, “We will not be surprised if they prefer to go slow on rate hikes since the government is also responding to inflation risks.”

Furthermore, Pathak says the RBI may not tweak the CRR rate in the next meeting. “Surplus liquidity in the banking system has fallen sharply in the last three weeks. Currently, the net excess liquidity parked under the RBI’s liquidity adjustment facility (LAF) window is close to Rs 3 lakh crore. We believe the RBI will be comfortable with this level of liquidity at this juncture,” he explains.