What went wrong at PharmEasy and can it find a cure?

The online drugs and medical services startup is reportedly raising Rs 2,400 crore in fresh funds at a 90 percent markdown to it previous valuation

The health care market in India is growing. The pharmaceutical sector is expected to grow at a CAGR of 37 percent between 2020 and 2025 to reach $50 billion, as per CARE Ratings.

Image: Shutterstock

The health care market in India is growing. The pharmaceutical sector is expected to grow at a CAGR of 37 percent between 2020 and 2025 to reach $50 billion, as per CARE Ratings.

Image: Shutterstock

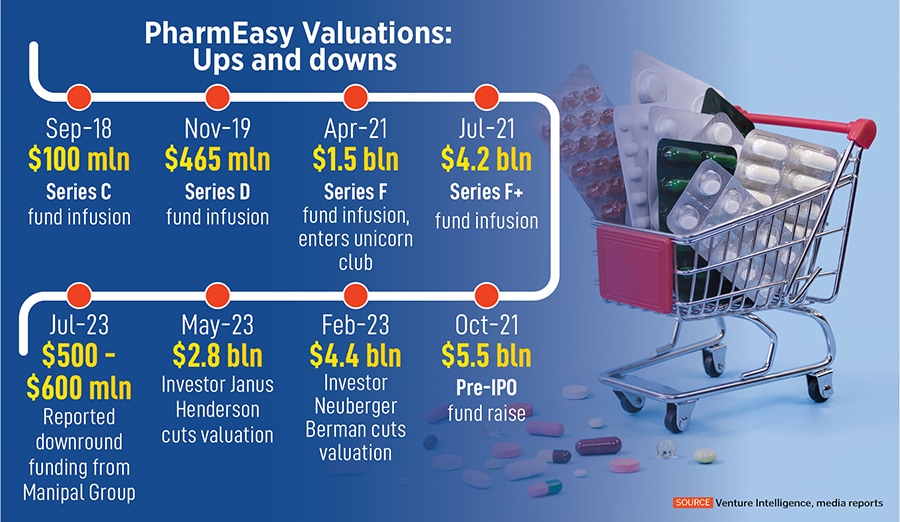

If PharmEasy’s reported Rs 2,400 crore rights issue plays out over the next few weeks, it would have taken less than two years for the online pharmacy’s valuation to plummet from its peak of $5.5 billion in October 2021 to around $600 million. That’s a 90 percent markdown.

Mumbai-based PharmEasy was once the largest online drugs and medical services platform in India. Backed by top investors like Temasek, TPG Growth, Prosus (formerly Naspers), Facebook co-founder Eduardo Saverin’s B Capital and Nandan Nilekani’s Fundamentum Partnership, among others, it raised a total investment of $1.2 billion across 16 funding rounds since its launch in 2014. It even bought Thyrocare Technologies, a profitable testing and diagnostics chain, in June 2021. Although PharmEasy paid a premium for it, the deal made sense at the time. It would help the online pharmacy move from peddling low-margin drugs to selling high-margin testing services.

Besides, the health care market in India is growing. The pharmaceutical sector is expected to grow at a CAGR of 37 percent between 2020 and 2025 to reach $50 billion, as per CARE Ratings.

So how did PharmEasy get here, from its vantage point? And can it recover?

“The business was doomed from Day 1,” says a former employee speaking to Forbes India on the condition of anonymity. That’s because of the nature of the business.

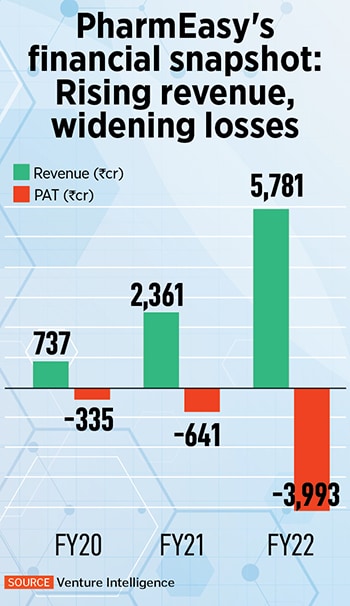

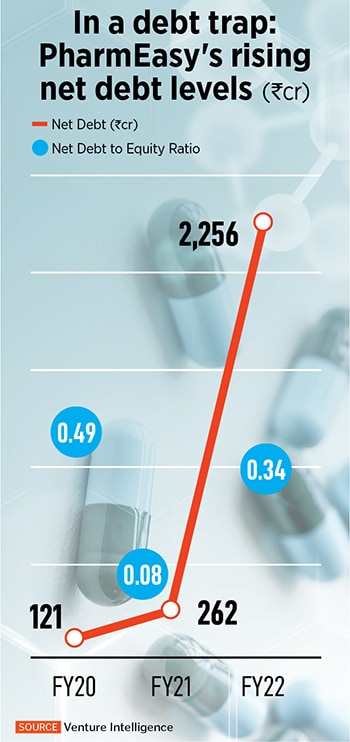

As a result, the net debt of API Holdings, PharmEasy’s parent, grew from Rs 262 crore in the year ended March 2021 to Rs 2,256 crore in the year ended March 2022, according to Venture Intelligence, a data provider. Its net debt-equity ratio worsened from 0.08 to 0.34 during the same period. Revenues grew 2.5x to Rs 5,781 crore in the same period, but losses widened more than 6x to Rs 3,993 crore.

As a result, the net debt of API Holdings, PharmEasy’s parent, grew from Rs 262 crore in the year ended March 2021 to Rs 2,256 crore in the year ended March 2022, according to Venture Intelligence, a data provider. Its net debt-equity ratio worsened from 0.08 to 0.34 during the same period. Revenues grew 2.5x to Rs 5,781 crore in the same period, but losses widened more than 6x to Rs 3,993 crore.  “The investors are calling the shots at this point. The co-founders don’t have any say,” says the senior employee. Pai declined a request for comment on the matter. PharmEasy did not respond immediately to Forbes India’s request for comment.

“The investors are calling the shots at this point. The co-founders don’t have any say,” says the senior employee. Pai declined a request for comment on the matter. PharmEasy did not respond immediately to Forbes India’s request for comment.