Why sovereign funds are lapping up tech IPOs

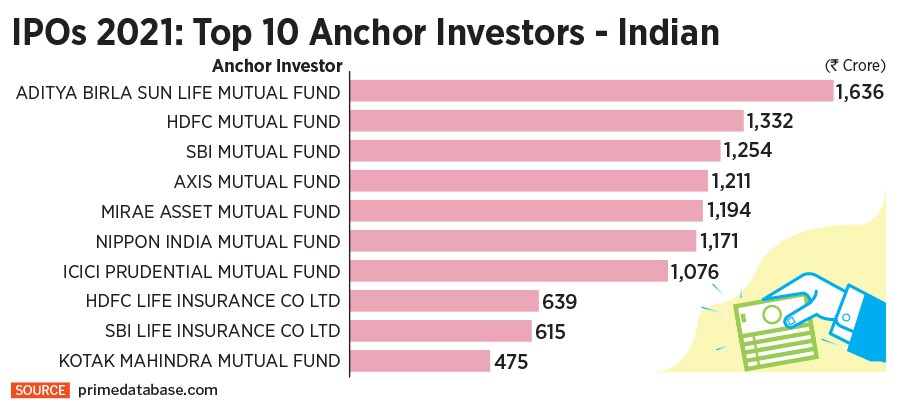

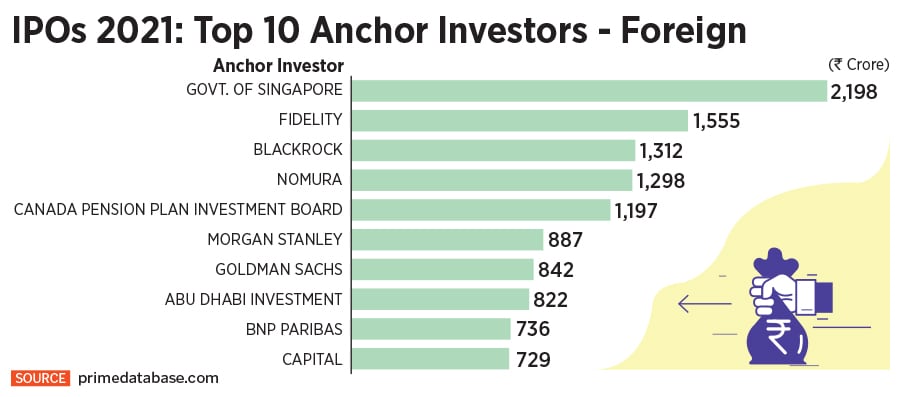

During 2021, three sovereign wealth funds—GIC, CPPIB and ADIA—made it to the top ten anchor investor list in India, a reflection of trends like internet penetration, the increasing size of IPOs and their belief in the India story

Presence of anchor investors—institutional investors who are allotted shares of a company just before the opening of the initial public offering (IPO) to the public—is a reflection of the large fund’s confidence in the company, like the anchoring of a ship

Presence of anchor investors—institutional investors who are allotted shares of a company just before the opening of the initial public offering (IPO) to the public—is a reflection of the large fund’s confidence in the company, like the anchoring of a ship

Image: Shutterstock

Anchor investors are walking on two different paths when it comes to investing in new age startup companies in India.

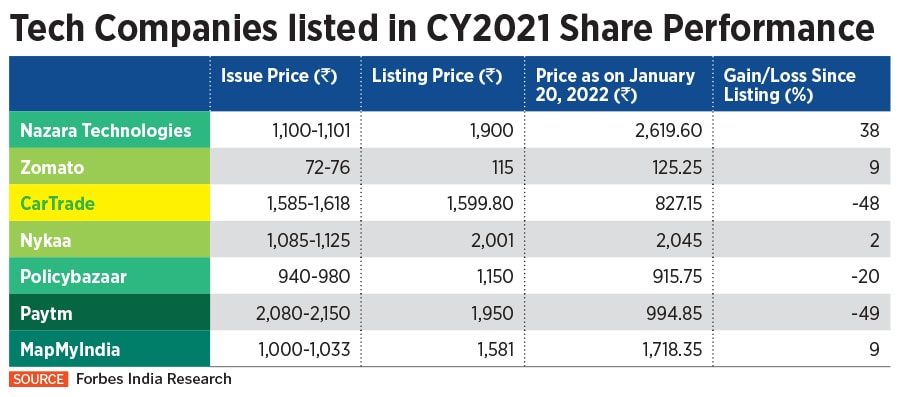

The presence of anchor investors—institutional investors who are allotted shares of a company just before the opening of the initial public offering (IPO) to the public—is a reflection of the large fund’s confidence in the company, like the anchoring of a ship. During 2021, sovereign wealth funds, global funds and domestic mutual funds deployed heavily in anchor books, especially of startup or tech stocks. But currently startup stocks are under tremendous pressure as most of them are trading either below or close to their listing prices (see chart) which has put domestic mutual funds on shaky ground as they have started selling down their exposure in some of these companies. Sovereigns, however, are sitting tight, for now.

Take the case of Paytm. During the largest initial public offering of 2021, payments firm Paytm (One97 Communications Ltd) raised Rs 8,235 crore from anchor investors as part of its initial public offering of Rs 18,300 crore. It was, of course, one of the largest capital market listings in India since Coal India Ltd. The anchor book was majorly led by global funds which include sovereign wealth and pension funds like Government of Singapore’s GIC, Canada Pension Plan Investment Board (CPPIB), Abu Dhabi Investment Authority (ADIA) and Pension Fund Association (a public pension located in Tokyo) among others. To be fair, Paytm had 122 anchor investors, but CPPIB alone cornered 11.4 percent of the anchor book with an allocation of Rs 937.83 crore. Government of Singapore acquired shares worth Rs 435.32 crore. In all this brouhaha, domestic mutual fund houses collectively bought in Rs 1,050 crore or nearly 12.75 percent stake in the company.

But what has transpired since November 18, when the company listed on the bourses with a discount of 9 percent, is a different story altogether. Paytm offered its share to investors in a price band of Rs 2,080-2,150 apiece and listed at Rs 1,950 per share. After one month, when the lock-in period for anchor investors was over, the share came under heavy pressure and on December 15, as 539887 shares changed hands, the share fell 13 percent (during intraday) though it recouped its losses by the end of the day and closed at Rs 1,380.05 per share.