Why the RBI mustn't take its eyes off inflation yet

Retail and wholesale inflation as well as global commodity prices may have declined, but a likely shortfall in the balance of payments and a weakening rupee could add to MPC's woes

Shaktikanta Das, Governor of Reserve Bank of India. After watching inflation surge from the sidelines for many months, India’s central bank sprung into action to increase rates and tame rampant inflation. Image: Anshuman Poyrekar/Hindustan Times via Getty Images

Shaktikanta Das, Governor of Reserve Bank of India. After watching inflation surge from the sidelines for many months, India’s central bank sprung into action to increase rates and tame rampant inflation. Image: Anshuman Poyrekar/Hindustan Times via Getty Images

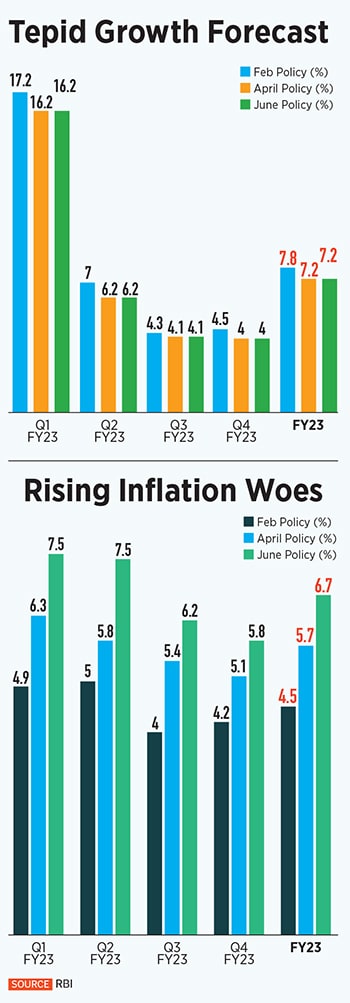

In its July bulletin, the Reserve Bank of India suggested that inflation may be peaking, and will align with the tolerance band of 2 to 6 percent by the fourth quarter of the current fiscal year. That’s the central bank’s baseline scenario. On a more optimistic note, the RBI doesn’t rule out the possibility that the “easing of inflation could be even sooner and faster”. The key is the direction of change in inflation—not its level—in these extraordinary times, it said.

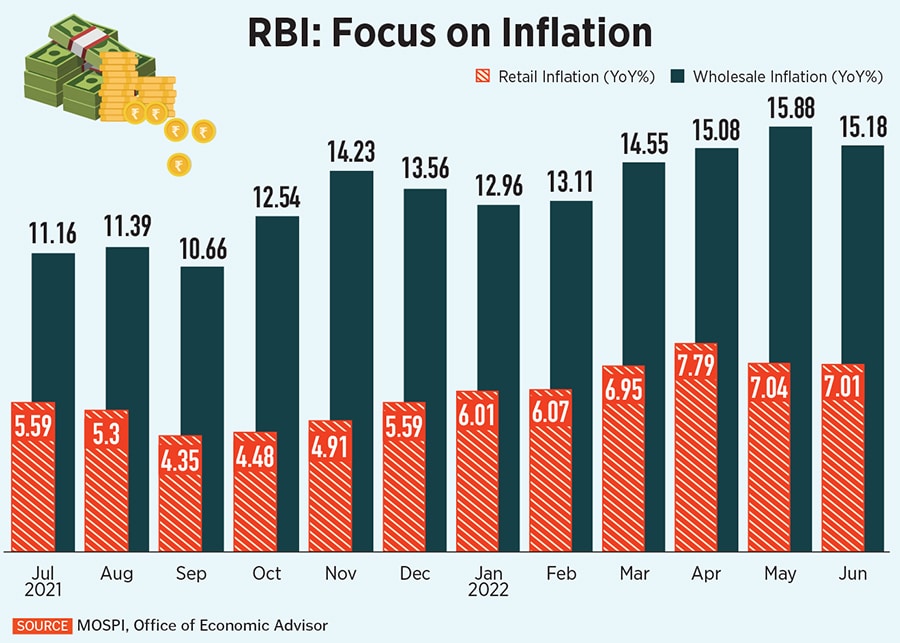

However, economists caution that inflationary risks cannot be downplayed at this juncture. The central bank must focus on steps to rein in inflation, despite the month-on-month decline in CPI and WPI inflation prints (see table) and a 20-40 percent decrease in global commodity prices. Rather, the recent cool-off in input prices can help the RBI pull inflation down to 6 percent levels by March next year, if it continues to tighten rates.

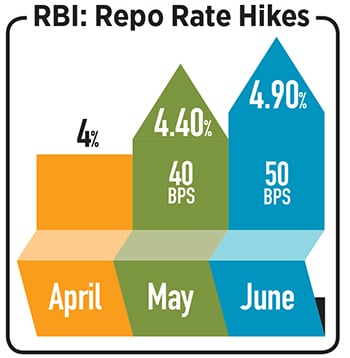

After watching inflation surge from the sidelines for many months, India’s central bank sprung into action to increase rates and tame rampant inflation. Over two tightening moves in May and June, the Reserve Bank of India raised the benchmark rate by a cumulative 90 basis points to 4.9 percent. As the Reserve Bank’s rate-setting panel readies to meet on August 3 to mull interest rates, most economists are expecting the repo rate to go up by 25 to 50 basis points.

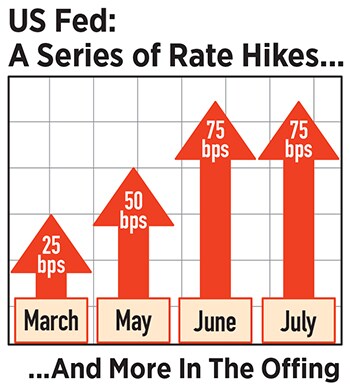

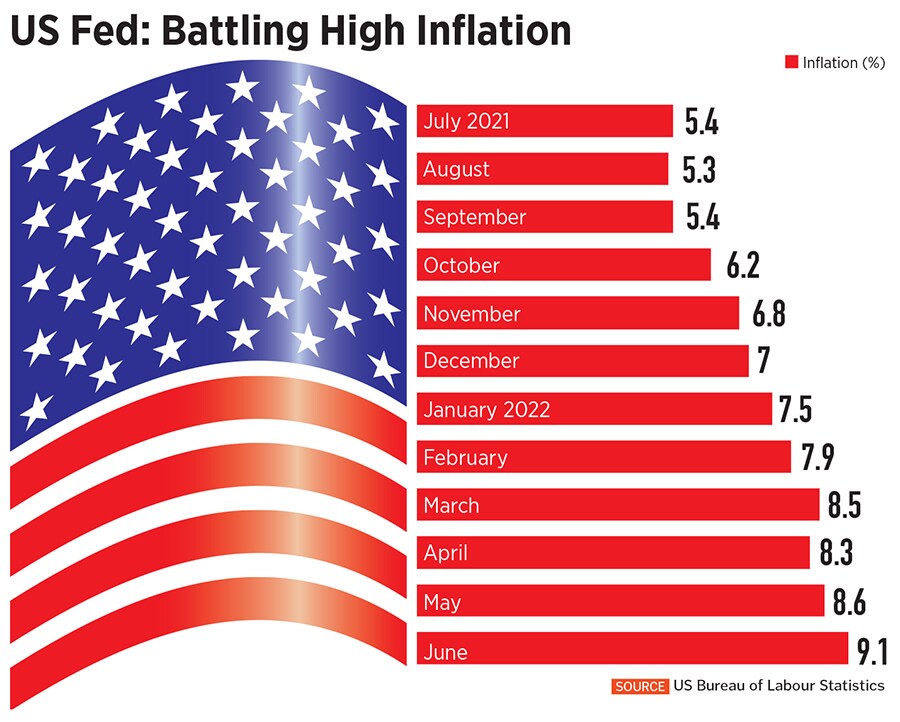

US Fed: Series of rate hikes

In its July meeting, the US Federal Reserve has hiked rates by 75 basis points for the second straight time (see table). The policy rate is now perched close to its long-run estimate of 2.5 percent. It admitted that recent indicators of spending and production had softened, but with inflation at 9.1 percent (see table) the US Federal Reserve has its task cut out as it seeks to get inflation back to 2 percent. In its own words, the risk of tightening too much in the short run is less than the risk of tightening too little.

“The RBI will remain focused on clamping down domestic inflation in the August policy. With no surprises from the Fed, we expect the RBI to remain on track to hike repo rate by 35 bps while maintaining a hawkish stance,” says Suvodeep Rakshit, senior economist, Kotak Institutional Equities.

“The RBI will remain focused on clamping down domestic inflation in the August policy. With no surprises from the Fed, we expect the RBI to remain on track to hike repo rate by 35 bps while maintaining a hawkish stance,” says Suvodeep Rakshit, senior economist, Kotak Institutional Equities.

Besides, economists say inflation in India tends to be sticky and since the pandemic large firms have gained pricing power and may begin to pass on higher input costs to consumers. HSBC India’s chief economist Pranjul Bhandari says the RBI may have to do more to anchor inflation expectations. “For instance, it may have to experiment with new techniques like raising rates earlier rather than later in the cycle, as a way of keeping inflation expectations anchored without too much cumulative tightening,” she notes.

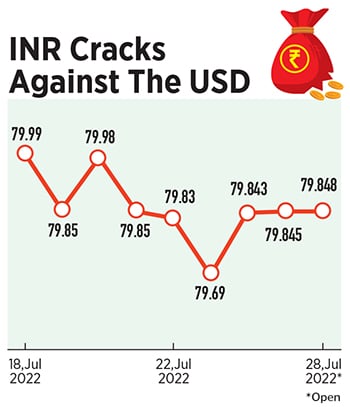

Besides, economists say inflation in India tends to be sticky and since the pandemic large firms have gained pricing power and may begin to pass on higher input costs to consumers. HSBC India’s chief economist Pranjul Bhandari says the RBI may have to do more to anchor inflation expectations. “For instance, it may have to experiment with new techniques like raising rates earlier rather than later in the cycle, as a way of keeping inflation expectations anchored without too much cumulative tightening,” she notes.  In a situation wherein the balance of payments is in deficit and the US dollar continues to climb against the Indian rupee, the RBI estimates that CPI inflation could potentially rise by 20 basis points for every 5 percent INR depreciation.

In a situation wherein the balance of payments is in deficit and the US dollar continues to climb against the Indian rupee, the RBI estimates that CPI inflation could potentially rise by 20 basis points for every 5 percent INR depreciation.  In the August meeting, analysts and economists do not expect a revision in growth and inflation forecasts. Most economists see a 35 basis points rate hike as a base case scenario, but do not rule out the possibility of a smaller rate cut of 25 basis points or a steeper rate cut of 50 basis points.

In the August meeting, analysts and economists do not expect a revision in growth and inflation forecasts. Most economists see a 35 basis points rate hike as a base case scenario, but do not rule out the possibility of a smaller rate cut of 25 basis points or a steeper rate cut of 50 basis points.