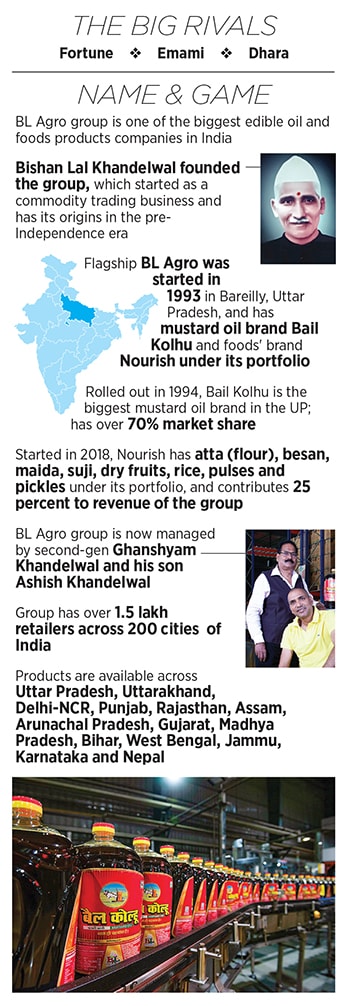

BL Agro's Ashish Khandelwal wants to continue UP reign, not be biggest in India

Calling Ashish Khandelwal a risk-taker may be defining him mildly. He stood tall in the face of an epidemic to protect his brand, made TV commercials for mustard oil, shook up the market with new packaging, and more, to build BL Agro into a diversified foods and FMCG business

(From left) Ashish Khandelwal, managing director, and Ghanshyam Khandelwal, chairman of BL Agro at the Bail Kolhu packaging plant in Bareilly

Image: Amit Verma

(From left) Ashish Khandelwal, managing director, and Ghanshyam Khandelwal, chairman of BL Agro at the Bail Kolhu packaging plant in Bareilly

Image: Amit Verma

1998, Bareilly, Uttar Pradesh. Ashish Khandelwal had a ‘crushing’ debut in the family business. “I had an ironical beginning,” recalls the third-generation entrepreneur, alluding to his not-so-memorable induction into the business of edible mustard oil. “The seeds are crushed and pressed… I was also undergoing a similar emotion,” he smiles. It was 1998, North India was in the grip of a deadly dropsy epidemic caused by adulterated edible mustard oil, and the government banned the sale of mustard oil—both packed and loose. The Khandelwals, who were into bulk oil trading till then, started a consumer brand—Bail Kolhu—in 1994, and two years later, launched big tin packs. In 1998, mustard suddenly became untouchable, most of the traders migrated to other commodities, and the Khandelwals emerged as the lone warriors. The young entrepreneur went against the grain, mustered courage, and decided to bide the storm.

If a steep hike in price threatened to upset the kitchen calculus of the buyers, selling oil in bottles came as a cultural shock. Understandably, their knee-jerk reaction ranged from ridiculing the move—“Who buys oils in bottles? People don’t even buy bottled mineral water”—to questioning the business sense behind rolling out smaller packs. “Indians buy in tins, which lasts for a month. Does one litre make sense?” asked a set of market observers, who wrote a premature epitaph of the packaging innovation. Fortunately for Khandelwal, the gambit worked after a relentless marketing push of over a year.

The next big challenge was visibility. The beauty of bulk trading, Khandelwal explains, is that one doesn’t need to build a consumer brand. It’s a ‘push’ business. The launch of smaller consumer packs, unfortunately, meant that Bail Kolhu was now entering into a B2C segment, which is a ‘pull’ business. This also meant the fledgling product had to morph into a brand. High-quality edible oil and a well-oiled retail network were not enough to make Bail Kolhu a household brand. It needed visibility, which was missing. “Jo dikhta hai woh bikta hai (what’s visible sells),” says Khandelwal, who decided to press the advertising button.

The next big challenge was visibility. The beauty of bulk trading, Khandelwal explains, is that one doesn’t need to build a consumer brand. It’s a ‘push’ business. The launch of smaller consumer packs, unfortunately, meant that Bail Kolhu was now entering into a B2C segment, which is a ‘pull’ business. This also meant the fledgling product had to morph into a brand. High-quality edible oil and a well-oiled retail network were not enough to make Bail Kolhu a household brand. It needed visibility, which was missing. “Jo dikhta hai woh bikta hai (what’s visible sells),” says Khandelwal, who decided to press the advertising button.Two years later, in 2000, the young founder was making an audacious move of advertising on national television (TV), and that too on prime-time slots. Bail Kolhu was making a grand entry in the hottest soap opera aired across the Hindi heartland of India: Kahaani Ghar Ghar Ki. “We spent ₹60 lakh in advertising,” he claims. “Back then, it was a staggering amount. No mustard oil brand had ever done such a kind of advertising.”

The move won eyeballs, visibility, and criticism. The senior Khandelwal was greeted with caustic reactions in his home state: “Aapka beta paagal ho gaya hai (your son has gone crazy), “kitne paisey phoonkh diye (he has burnt so much money), “saabun aur shampoo nahin hai, tel hai. TV pe dikhne se nahin bikega (It is oil and not soap or shampoo. Advertising on TV won’t help).” The patriarch remained undeterred. He had absolute faith in his son. “Advertising builds recall and the brand,” he tried to counter the naysayers.

Fast forward to 2014. The senior’s Khandelwal faith was jolted to the core. His son had decided to do something unthinkable: An investment of ₹100 crore in importing world-class machinery. “It was unprecedented in the history of edible oils in Uttar Pradesh and the country,” says Khandelwal, alluding to his move to push the production from manual and semi-automatic to fully automatic.

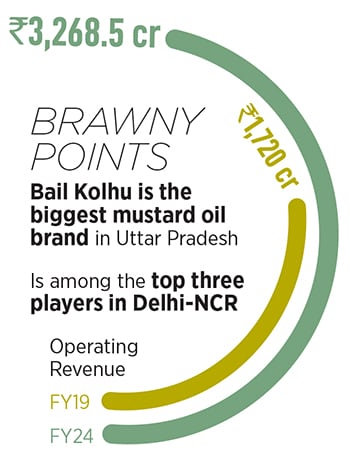

The move was imperative, Khandelwal explains. BL Agro Industries, the parent company which has Bail Kolhu as its flagship brand, needed to modernise and automate operations to undertake a new phase of growth in its journey. By FY14, the company had clocked a turnover of ₹1,687 crore and a PAT (profit after tax) of ₹19.26 crore. “It was the biggest and riskiest decision of my life,” recalls Khandelwal who crisscrossed several European and American countries for over six months in his quest to buy the best machines. His father, understandably, was getting jittery. “If you lose, your critics win. But if you win, I will win,” he had a heart-to-heart talk with his son. In a little over 12 months, Khandelwal recovered the investment. “We never looked back,” he says.

The move was imperative, Khandelwal explains. BL Agro Industries, the parent company which has Bail Kolhu as its flagship brand, needed to modernise and automate operations to undertake a new phase of growth in its journey. By FY14, the company had clocked a turnover of ₹1,687 crore and a PAT (profit after tax) of ₹19.26 crore. “It was the biggest and riskiest decision of my life,” recalls Khandelwal who crisscrossed several European and American countries for over six months in his quest to buy the best machines. His father, understandably, was getting jittery. “If you lose, your critics win. But if you win, I will win,” he had a heart-to-heart talk with his son. In a little over 12 months, Khandelwal recovered the investment. “We never looked back,” he says.The next big bet came in 2018 when Khandelwal decided to diversify into the foods and FMCG business, and rolled out the Nourish brand to sell atta (flour), besan, maida, suji, dry fruits, rice, pulses, and pickles. Six years on, the brand makes up around 25 percent of the revenue of the group, which had an operating revenue of ₹3,268.51 crore and a PAT of ₹12.5 crore in FY24. Bail Kolhu, meanwhile, has emerged as the biggest mustard oil brand in Uttar Pradesh, the third biggest in Delhi-NCR, and now has a retail footprint across Uttar Pradesh, Uttarakhand, Haryana, Punjab, Delhi NCR, and Bihar.

Also read: How MTR has stayed true to its Kannadiga core

It, however, doesn’t have national aspirations. “I don’t want to be the biggest in India,” says Khandelwal. Bail Kolhu, he claims, has a 70 percent market share in Uttar Pradesh. “If I can maintain the 70 percent mark, I would be delighted,” he says. Any IPO plans? None, he says. “I don’t want external capital. My company is on track to becoming debt-free in a year. Why would I tap the public market or private equity?” he asks. Uttar Pradesh, he underlines, might just be a state in India but it’s a country or a few countries combined in terms of the population. Combine the population of Germany, the UK and France, and you get Uttar Pradesh. “I am contended. I have a dominant market share here,” he smiles.

But how did Bail Kolhu manage to fend off the fight from big rivals such as Fortune, Emami and Dhara? And what about local price warriors that might have tried to play spoilsport from time to time? Khandelwal shares his ‘crushing’ recipe. First, Bail Kolhu never tried to take any rival head-on. “Rivalry might end up giving you a bloated topline, but it will eventually kill your bottom line,” he reckons. “I am in the business to make money, and not to burn money.”

There was another trick used to stump the competition from the big boys. Whenever the national Goliaths tried to flex their muscle in Uttar Pradesh, they took the easy way of playing price warrior. “When they said their brand would be ₹10 cheaper than ours, we slashed our margin,” he smiles. While the rivals were already coming at a low price, Bail Kolhu sacrificed its margin but was still making money. “For two to three years, we ran the business on negligible margins,” he adds. Being a regional heavyweight also brought with it additional advantages such as maintaining regular touch with retailers, kiranas, and shopkeepers, and building trust and credibility by ensuring timely payments and offering incentives to the channel partners. “Our family has been in the trading business since the 1940s. An outsider can’t match this,” he adds.

Bail Kolhu, reckon industry experts, has played to its strength. In India, edible oil consumption has traditionally been based on the locally available seeds. Take, for instance, peanut oil in Gujarat, and sesame oil in Tamil Nadu. Traditionally, mustard oil has been used for daily cooking in North India and large parts of Eastern India. Apart from special applications like making pickles, mustard oil also has a high smoke point, making it ideal for deep frying. “It is one of the oils that doesn’t solidify in winter. This makes it ideal in the North and East,” contends KS Narayanan, a food and beverage expert. Bail Kolhu identified this niche and has been able to consistently offer quality in terms of colour, taste, aroma and pungency.

The first-mover advantage also brought a sea of users. “They were one of the first to deliver in small retail packs ranging from 200 ml to 15-litre tins,” says Narayanan, adding that the brand built a solid distribution through kiranas, general stores, and wholesalers. “This enabled them to become a household name and build a formidable moat,” he adds. The challenge, he points out, would be to stay nimble, cement its bonding with the consumers, and regularly nourish its brand story.

Khandelwal, for his part, reckons that his biggest challenge is to ensure that BL Agro keeps firing on the twin engines of Bail Kolhu and Nourish. “I just need to do whatever I have been doing for years: Focus on our strength, and not fret over any weakness,” he signs off.