How MP Ahammed built Malabar Gold & Diamonds: Small shop in Kerala to Rs 51,000 crore behemoth

Malabar Gold & Diamonds is India's largest jeweller by revenue, and sixth largest globally, with 213 showrooms in India and 140 globally. Here's how the behemoth was created

MP Ahammed, Chairman, Malabar Gold & Diamonds

Image: Mexy Xavier

MP Ahammed, Chairman, Malabar Gold & Diamonds

Image: Mexy Xavier

He may be blissfully unaware of it, but Amitabh Kant, the renowned civil servant, and India’s G20 Sherpa, may have inadvertently helped build the country’s largest jewellery brand by revenue.

In 1993, MP Ahammed, a copra dealer from northern Kerala, had made up his mind to set up a jewellery business in a 200-sq-ft shop in Kozhikode in Kerala. Kant was the district collector in Kozhikode and had become something of a household name in the city, after a slew of initiatives aimed at promoting the region’s heritage and improving its infrastructure.

“When Amitabh Kant was the district collector, the development of the Malabar region was a matter of big discussion in Kerala,” Ahammed says. “Malabar was always in the news, its history was discussed. Kant had launched various programmes with the name Malabar in it. So, when we decided to launch our jewellery business in 1993, we thought it befitting to build our brand around Malabar. Unlike individual names, Malabar represented a region with a great history.”

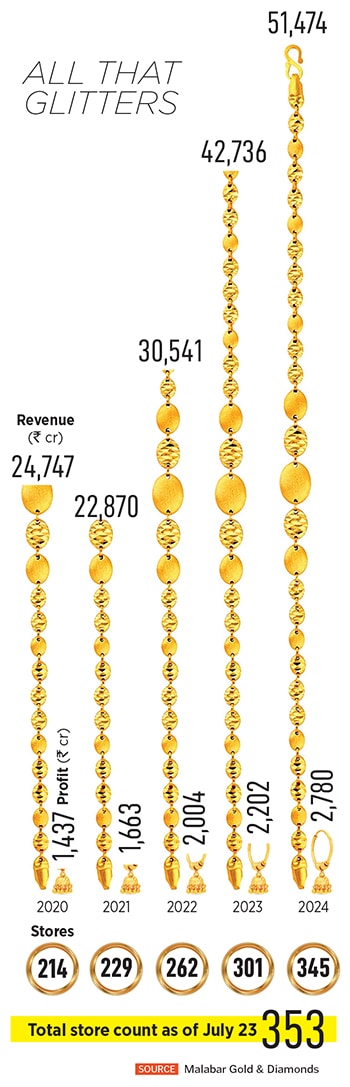

Thus was born Malabar Gold and Diamonds, a jewellery behemoth with an annual revenue of over ₹51,000 crore in FY24, making it India’s largest jeweller by revenue. The company operates 213 showrooms in India, and 140 across the globe. Rivals Joy Alukkas and Kalyan Jewellers lag far behind at 160 and 190 stores, highlighting the pace at which Malabar Gold has been growing in recent years. Only Tanishq has more stores—464.

“We derive our strength from many,” says Ahammed about how the group has grown through a collaborative effort. “Time from those who have time, talents from the talented, resources from the resourceful, and investment from the people who have the money.” Today, the company employs over 21,000 people across 15 business units and has a presence across 13 countries and 19 Indian states.

But most importantly, Ahammed and Malabar have held on to a rather unique operating model. The company has over 4,000 investors and operates its business through numerous entities. The model is simple, yet complex. Whenever Malabar has gone on to set up an outlet in a city or a new region, it would partner with local businessmen or existing partners and give them a share in the company that operates that outlet or the region. There are outlets where it has gone solo too. But in the others, the parent company operates the day-to-day affairs of the business, with a tight grip on the quality in addition to holding the majority stake in that arm.

In return, it would distribute the profits from the store to the investors while also offering interest on compulsory convertible debenture (CCD), capped at 15 percent. CCD is a type of bond that must be converted into stock by a specified date. All the stores are built on purchased land, which means that the store is backed against an appreciating asset (land) usually located in prime locations.

“Ours is a unique model and nobody else can do it,” says Ahammed, who serves as chairman of Malabar Group. “We just wanted to grow and expand the business. That’s how this model was developed. But, at the same time, it must be clean. If there is a mistake, we take strict action which means we do not see manipulation in our business or any type of illegal activity.”

From the Bottom Up

Ahammed’s journey into the world of gold is one of happenstance, once he understood the value of a brand.The son of an agriculturist, he was the youngest of six and the only son of his parents. His father was well over 60 when Ahammed was born and well regarded in his village of Karayad. Being the only son came with its set of challenges. Ahammed’s father didn’t want to send him far away from home for studies and instead enrolled him in a nearby parallel college to complete his pre-degree or pre-university programme. A parallel college isn’t affiliated to or recognised by a university or board.

In 1981, when Ahammed was 24, his father passed away. Shortly after, he packed his bags and moved Kozhikode, some 40 km away, to start a business of his own. He started with trading hill produce that included vegetables and spices, as was a common line of business then. A significant chunk of his trade involved copra, the dried flesh of the coconut, used to extract coconut oil.

“But there was significant risk in that business,” Ahammed recalls. “We used to send our produce to various parts of the country. But payments used to come in late, or in some cases, duplicate C Forms (a type of acknowledgement of the trade) were given. So it was a heavy risk, thin margin business.” It also didn’t help that a company, Mumbai-based Cococare, that Ahammed had sold goods worth ₹17 lakh to, had defaulted. Cococare made coconut oil and had a significant presence in Mumbai and western India. Ahammed had already pledged his property with State Bank of Travancore to raise money for the consignment.

“But there was significant risk in that business,” Ahammed recalls. “We used to send our produce to various parts of the country. But payments used to come in late, or in some cases, duplicate C Forms (a type of acknowledgement of the trade) were given. So it was a heavy risk, thin margin business.” It also didn’t help that a company, Mumbai-based Cococare, that Ahammed had sold goods worth ₹17 lakh to, had defaulted. Cococare made coconut oil and had a significant presence in Mumbai and western India. Ahammed had already pledged his property with State Bank of Travancore to raise money for the consignment. “When I met Cococare, they told me that Hindustan Unilever was interested in buying their business and that they were going to pay ₹22 crore for that,” Ahammed says. “They asked me to send some more raw materials to help keep up their production and the business running. I borrowed some more money from friends and sent them that. It was all a big risk. But, eventually, Cococare was bought by Unilever, and I got my money back.”

That crisis also taught Ahammed the importance of a brand. “I was stunned when they told me that despite making losses, the brand commanded ₹22 crore,” Ahammed says. “That’s when I realised the power of a brand and decided that I needed to build a brand.”

Around the same time, the economy was also undergoing a paradigm shift with the government unveiling the neo-economic policy, that allowed for greater privatisation and liberalisation of the country’s economy. The Indian rupee had begun to depreciate significantly, after the government decided to devalue the currency, going from ₹17.5 against the US dollar in 1990 to ₹30 by 1993.

Kerala, which boasted a large immigrant population based in the Middle East, provided a massive opportunity since remittances now found greater value. Gold was one of the most sought-after investments in the country as alternative investments were yet to gain traction. “My friend who was based in Mumbai told me gold prices will increase,” Ahammed says. “I had friends who were in the Middle East, and they had brought some gold and we bought it. We entered when gold price was ₹390 per gram and at the same time we also realised that real estate prices were likely to go up because of this cycle.”

Ahammed set up his first shop in Kozhikode, in a 200 sq-ft room, on the first floor of a building. He found numerous investors, particularly those working in the Middle East to put money into the business, while he held on to a 58 percent stake. “I was only 36, and I had the courage to do anything,” says the 67-year-old. “My sisters’ children also joined the business to help scale it up. It was a collective effort.”

Also read: How Joy Alukkas became India's richest jeweller

The Art of Scaling Up

The first store in Kozhikode was a huge success, largely because of Malabar’s focus on quality. The store, Ahammed says, insisted on selling only 22-carat gold, in addition to various schemes such as buyback and lifetime free maintenance of gold. “Our advertisements at that time said, for measuring the quality of milk, there is lactometer, for currency, there were detectors, and for gold, we used carat check analyser that we had imported,” Ahammed says. “We breathed quality and that found massive acceptance from the public.”By 1996, the company set up another store in the nearby town of Tirur before moving to a 700-sq-ft store in Kozhikode. The Tirur store was set up with newer investors and partners, again with Ahammed holding the majority stake. “Our policy was that people had different skills and we had to make use of all of them,” Ahammed says. “Some people were ready to work, some would ideate, some would bring the money. I was the leader.”

By 2008, the company set up its 20th outlet when it opened a store in the UAE, with its 100th outlet set up in Gurugram in 2013. Between 2013 and 2018, the group doubled its store count and has since grown to have more than 4,000 investors, with as many as 20 percent of those, or around 800, being employees of Malabar Gold & Diamonds.

Today, the company operates through a mix of franchise and own stores. The parent company manages the day-to-day affairs, staff, HR practices, design and manufacturing, and so on, keeping a tight grip on the operations, service and quality. Among its investors are the likes of billionaire Ravi Pillai who Ahammed had partnered with when he set up a business in Pillai’s hometown of Kollam.

“When we started in Hyderabad, there were some local investors who were ready,” Asher O, Ahammed’s son-in-law and the MD of Malabar Gold & Diamond’s India business, says. “The same with Bengaluru and in Dubai. In our case, the management is looked after by the parent company. A share of the profit must be given to the parent company. Some are franchises, some are own. The parent company is also an investor in the company that would operate the franchise.” Today, the group has over 120 entities, of which 43 companies operate 213 gold stores in India. Investors in the various entities have come through references or personal friendships.

In 2024, Malabar Gold and Diamond’s annual revenues stood at ₹51,474 crore, making it the sixth largest jewellery retailer globally. The group also handles 50 metric tonnes of bullion annually, or as much as the average weight of 10 Asian elephants.

“What they have been able to do is build up a huge brand without much brouhaha and entirely on the basis of trust,” N Chandramouli, CEO of market research firm TRA, says. “They have democratised their growth bringing in numerous investors and focussed on providing value and a sense of ease for the customer. That has been their biggest strength.”

Newer Frontiers

Now, with southern India firmly under its belt, the company is aggressively scaling up its presence in the western, eastern and northern regions. “The big growth will come from there,” Ahammed says. “In the South, we will see big growth from Tamil Nadu.” The company has earmarked plans for states such as Jharkhand, Goa, Assam, and Tripura, in addition to countries such as South Africa, Egypt, Bangladesh, Turkey and New Zealand.“If a store isn’t successful, we shut it down immediately,” Ahammed says. “We are in business for reasonable growth and profit. If it doesn’t happen, that means the decision is wrong and we need to correct it. There is no place for sentiment in business.” That’s also why, despite its foray into the textile business in 2005, the company shut down that business six years later when it realised that it wasn’t turning in profits. Today, apart from the gold and diamond business, the Malabar Group also has a real estate business, developing apartments, villas and malls in Kerala.

Over the next few years, apart from opening more jewellery stores, Malabar Gold & Diamonds is planning to go public, a tedious process considering how it will have to wind up its various companies and merge them all into one holding company. “We are looking to consolidate and make it into one company and go for an IPO,” Ahammed says. “For 30 years, there have been investors. Some have died, some may want to leave. We want to become a public limited company and be legally perfect. That means share swaps must happen and 50-odd companies must be made into one.”

The company has engaged the likes of EY, Deloitte and PWC to help with the process, and has set a target of 2026 for its listing, a timeline that it says could even be advanced. The international arm of the business, led by Ahammed’s son Shamlal, however, will remain separate.

India’s organised jewellery business, which comprises the likes of Joyalukkas, Kalyan Jewellers, Titan, Malabar Gold and Senco, among others, contributes to less than 40 percent of India’s gold purchases. The country is the world’s second largest consumer of gold, and consumption stood at 747.5 tonnes in 2023, according to World Gold Council (WGC) data. Demand for gold jewellery in 2023 stood at 562.3 tonnes compared with 2022, according to WGC. This year, the WGC expects gold consumption to rise to 900 tonnes, even as prices rise, signalling huge growth for retailers.

India’s jewellery retail sector was worth $80 billion (₹6.4 lakh crore) in FY24, according to estimates by brokerage firm Motilal Oswal. “Within this landscape, organised retail accounted for about 36 to 38 percent and comprised both pan-India and regional players,” Motilal Oswal said in a recent report. “The remainder of the jewellery retail sector continued to be dominated by the unorganised/local players, comprising over 500,000 local goldsmiths and jewellers. The total gold consumption in India was attributed to 66 percent for jewellery, and the remaining for bars and coins.”

The sector is expected to grow to $145 billion by 2028, of which the organised retail is expected to account for 43 percent. That has also meant that regionally focussed jewellers are stepping out of their comfort zones to foray into newer markets, either through their own stores or franchises, designing and manufacturing jewellery to cater to a pan-India clientele. “Gold is a gift article,” Ahammed says. “Wherever there is man and woman, gold will be in demand. It is also purchased to celebrate achievements, childbirth, and so on. We are researching various cultures and ornaments and bringing in innovation.”

Then there is also the greater reliance on technology with a focus on omnichannel distribution, in addition to technology-backed customer service, now that the company has already built up an enviable scale. “Our staff will be able to profile the customer at their fingertips,” Ahammed says. “We have brought in CRM (customer relationship management) which will help our staff to explain various schemes and give recommendations to a customer, whether they are in Australia or Uttar Pradesh.”

But challenges still exist, the biggest of which is gold smuggling. Of India’s official gold imports of over 700 tonnes a year, smuggled gold accounts for some 300 tonnes a year. “This is a big challenge,” Ahammed says. “Unaccounted business accounts for 70 percent in India and there is a big mafia at work.” India currently imposes a 15 percent import duty on gold, with another 3 percent as GST and 1.5 percent as income tax. “We push for responsible purchase and our gold is sourced through the London Bullion Market Association,” Ahammed says even as he roots for a reduction in import duty to help curb smuggling.

Gold is currently the third largest import in the country after petroleum and electronics, and Ahammed is now also gearing up for an electronics play under the Malabar brand. The company has set up Eham Digital, an electronics and home appliances division, with stores in Kerala. “We are studying the electronics industry,” Ahammed says. “The potential is huge, and there is a lot of opportunity.”

So how does he now look back at the journey, from a small 200 sq ft gold store to over 350 stores globally? “Our decisions have been perfect,” Ahammed says. “Now we have more investors than loans. They just want returns and growth. Our job is to build their confidence and grow worldwide.”

And what about Amitabh Kant? Has he had a chance to tell him about his contribution to inadvertently helping with the brand name? “I have thought of seeing him, but never had a chance of telling him,” Ahammed says. “But I will surely go meet him sometime.”

(This story appears in the 09 August, 2024 issue of Forbes India. To visit our Archives, click here.)