Can Paytm's lending business help shore up its share price?

Over the last 18 months Paytm has silently built out its loan distribution business. Yet the stock tanked 10 percent on the expiry of the lock-in period for pre-IPO investors earlier this week. What will it take to prop up the stock which is down 75 percent from its year-ago listing price?

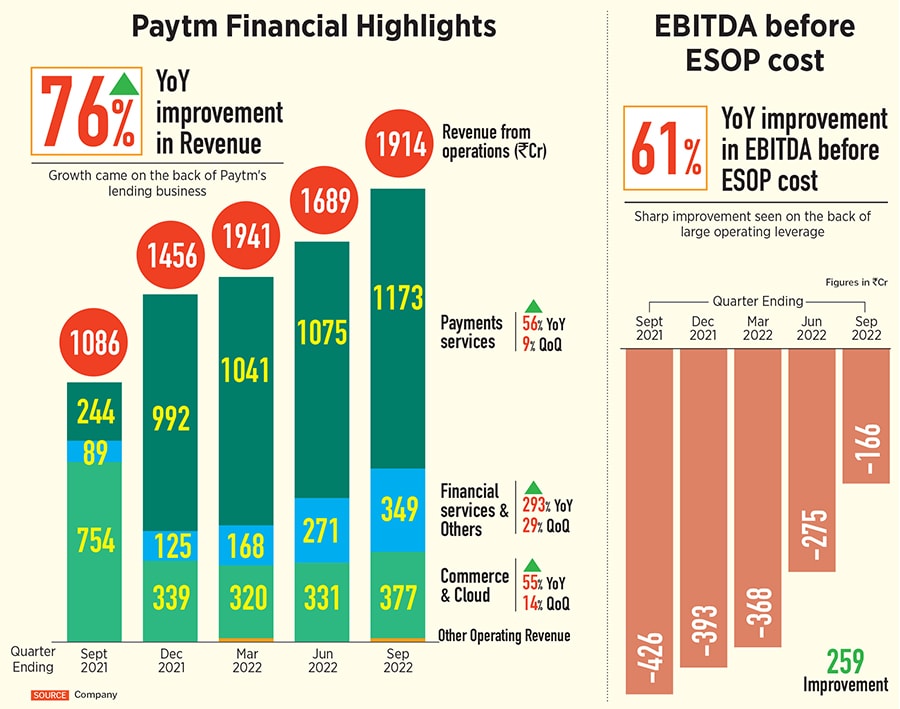

Paytm’s core payments services vertical grew 56 percent YoY and nine percent QoQ.

Image: Indranil Aditya/NurPhoto via Getty Images

Paytm’s core payments services vertical grew 56 percent YoY and nine percent QoQ.

Image: Indranil Aditya/NurPhoto via Getty Images

Shortly after Paytm announced its Q2FY23 results on November 8, the stock dipped slightly to around Rs 640. Results, however, were upbeat: Its revenue from operations grew 76 percent year-on-year to Rs 1,914 crore, implying an annual run rate of roughly Rs 8,000 crore or around $1 billion. Adjusted EBITDA (before ESOP costs) narrowed to Rs (166) crore, from Rs (425) crore in Q2FY22.

Despite the strong showing, the stock price is far short of its initial public offering (IPO) price of Rs 2,160 last November. A week after the results, the stock tanked further to around Rs 540 as Paytm’s lock-in period for pre-IPO investors expired on November 15. Softbank, one of its biggest backers with a 17.45 percent stake worth around $900 million, has started the process to sell 29 million shares or 4.5 percent of its holding worth $200 million. It’s currently trading at around Rs.549 on the Bombay Stock Exchange.

So where is Paytm’s stock heading and what will it take for it to recover?

“It’s very difficult to predict near term prices,” says Sameer Bhise, executive director at JM Financial where he serves as the lead analyst for finance and fintech companies. Zomato’s share price, for example, similarly tanked 11 percent after its lock-in for pre-IPO investors ended this July but recovered soon after. “Though fundamentally, the way we are looking at it, Paytm’s business model is shaping up reasonably well. Domestic investors have stayed away from the stock but over the next 12-18 months, as the move towards profitability continues, investors will start looking at it favourably.”

“Consistent improvement in profitability is a key catalyst for the stock,” echoes Manish Adukia, equity research analyst at Goldman Sachs, in a note. “We expect multiples for the stock to re-rate higher as Paytm approaches adjusted EBITDA breakeven by mid-CY23.”

A former senior Paytm employee who spoke with Forbes India on the condition of anonymity confirms, “They have changed their focus. Vanity metrics like GMV are no longer a priority.”

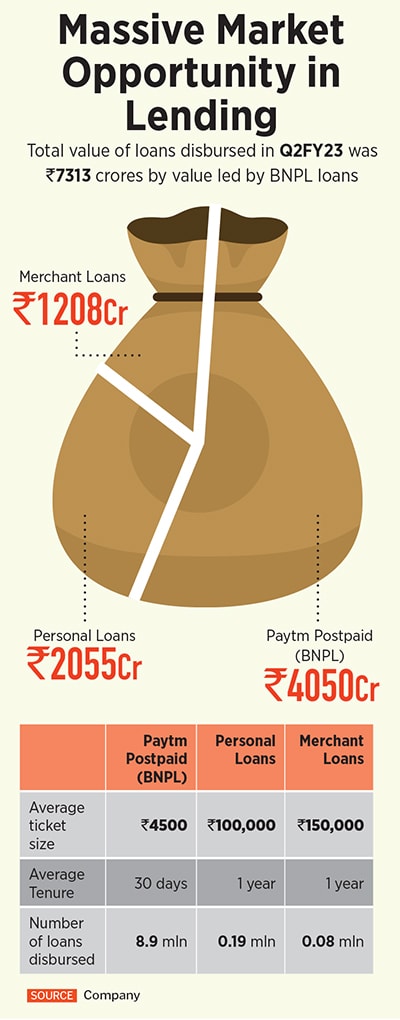

A former senior Paytm employee who spoke with Forbes India on the condition of anonymity confirms, “They have changed their focus. Vanity metrics like GMV are no longer a priority.”  BNPL loans, therefore, presently account for the lion’s share of Paytm’s loan disbursal business by number and value. “Even though Paytm’s credit business is largely built on BNPL loans right now, the scope for growth on the lending model is quite large,” says Bhise.

BNPL loans, therefore, presently account for the lion’s share of Paytm’s loan disbursal business by number and value. “Even though Paytm’s credit business is largely built on BNPL loans right now, the scope for growth on the lending model is quite large,” says Bhise.