Corporate governance at India Inc: Understanding the decadal shift

Shareholder activism is here to stay, as many recent instances of pushback at companies like Zee and JSPL have shown. The writing on the wall is clear: If you want to build a public company, investors need to have an equal footing

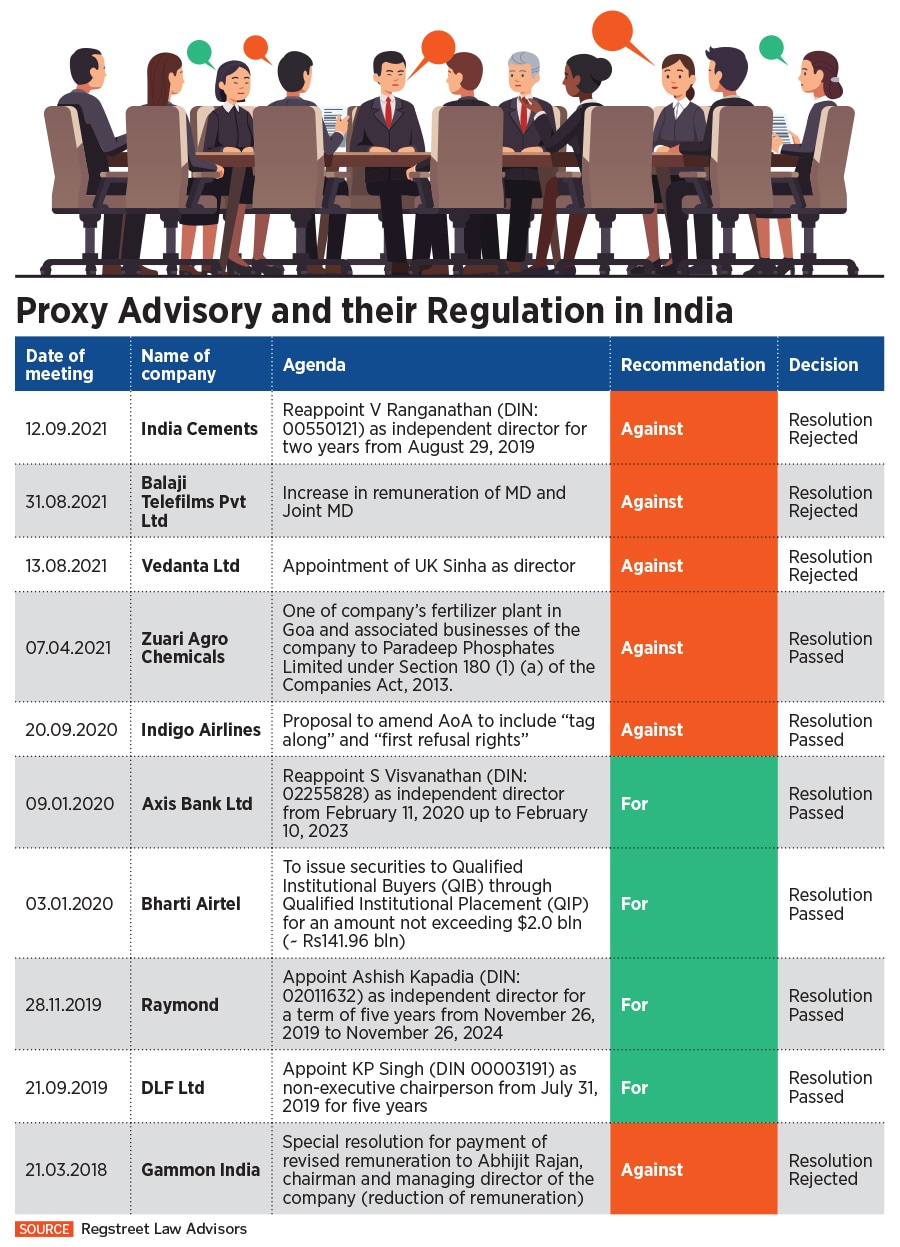

Shareholder activism is not new to India but over the last four years especially, proxy advisory firms have come to play a significant role in shareholder voting

Shareholder activism is not new to India but over the last four years especially, proxy advisory firms have come to play a significant role in shareholder voting

Illustration: Chaitanya Surpur

Late night on September 13, around 9:15 pm, Bombay Stock Exchange (BSE), the oldest bourse in India, updated a notice. One of the largest media networks in the country, Zee Entertainment Enterprises Ltd (Zee), had announced that a day before, it had received a letter from its institutional shareholders Invesco Developing Markets Fund (formerly Invesco Oppenheimer Developing Markets Fund) and OFI Global China Fund LLC—who collectively hold 17.88 percent shares in the company—having requisitioned for calling an extraordinary general meeting (EGM) of company shareholders under Section 100(2)(a) under the provisions of Companies Act, 2013, for removal of key directors from the board of the company.

Basically, the investors wrote to the company that it is seeking removal of Punit Goenka who is the managing director and a director on the board of the company and two other directors Manish Chokhani, and Ashok Kurien. Later, Kurien and Chokhani resigned citing personal reasons but over the next forty-eight hours, Zee pulled a merger card with Sony, while it is still under 90-day due diligence, and announced that Punit Goenka will remain the managing director of the newly-formed entity that will be listed on the bourses. In its second letter to the board on September 23, Invesco reiterated its EGM requisition, where the demands are in contrast with the terms of the Zee-Sony non-binding merger announcement.

While the news took the business community by storm, for some it did not come as a surprise. A year ago, during the annual general meeting (AGM) of Zee, corporate governance and proxy advisory firm Institutional Investor Advisory Services (IiAS) had, in fact, recommended voting against Punit Goenka’s re-appointment as managing director.

“We had recommended (voting against the appointment) last year but the shareholders did not vote against, but some are asking for change this year,” says Amit Tandon, founder and managing director at IiAS. Tandon started the firm in 2011 and in the early days they were assessing 287 companies which were part of NSE200 and Futures and Options stocks. As per his last count they now analyse over 850 companies.