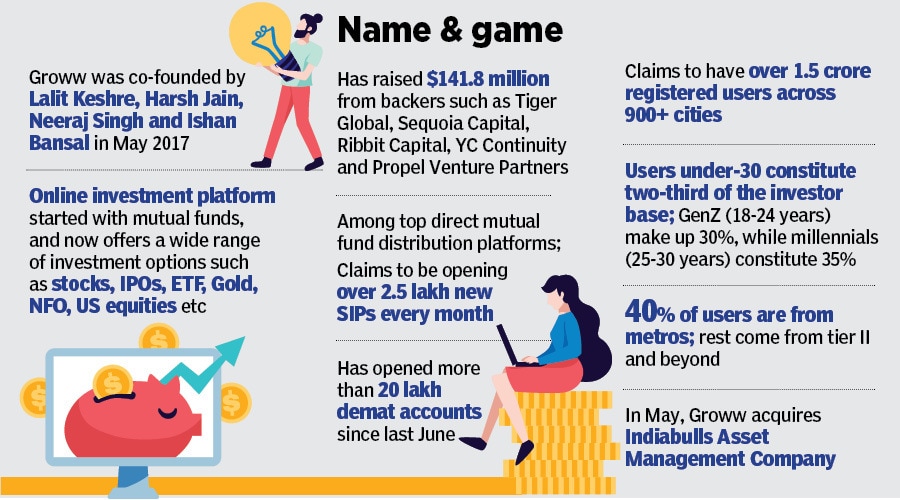

How four ex-Flipsters built Groww into a unicorn

The online investment platform flipped traditional investment logic and scaled at a staggering pace in four years. Can it keep growing?

(From left) Neeraj Singh, Harsh Jain, Lalit Keshre, Ishan Bansal, co-founders, Groww

(From left) Neeraj Singh, Harsh Jain, Lalit Keshre, Ishan Bansal, co-founders, Groww

In 2016, when Sonia Chauhan was exploring investment options in mutual funds, the young fashion designer got intrigued by two things. First, companies were bombarding the viewers with all kinds of MF commercials on the television. Second, the ‘disclaimer voice’ towards the end of advertisements suddenly switched gears to supersonic speed: Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully. “I could never figure out whatever jumbo mumbo they puked in the end,” she laughs. One word, though, stood out clearly: ‘Risk’. “I couldn’t understand and stayed away initially,” says the 27-year-old from Bengaluru. “I thought it’s risky.”

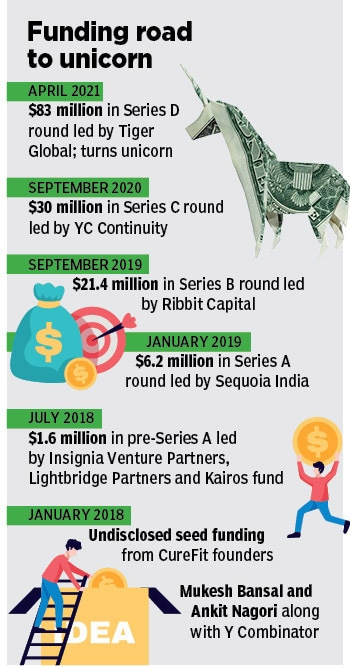

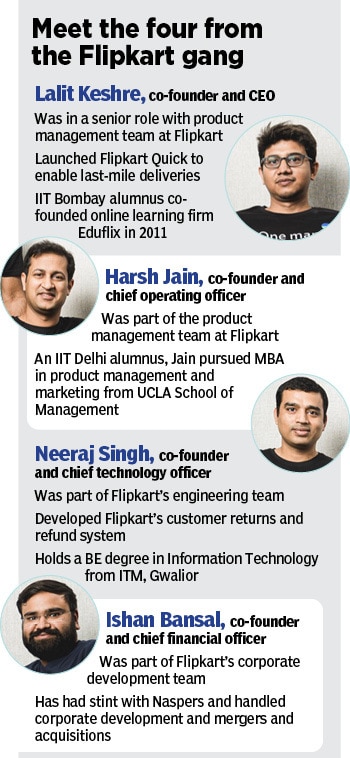

A year later, in May 2017, Lalit Keshre very well knew the risk involved. He, along with his three friends from Flipkart—Harsh Jain, Neeraj Singh and Ishan Bansal—rolled out Groww, a direct mutual fund distribution platform. The four Flipsters—former Flipkart executives—were trying to take a stab at simplifying the process of buying financial products in India, which was largely slow, complex and opaque.

The biggest risk, though, still remained: Subdued consumer appetite. Less than 3 percent of population invests in equities in a country which has an estimated investible income population of over 200 million. What was also hampering efforts in getting people to come online to buy MFs was a lack of credible option. Keshre explains: While the intent to shift from traditional assets to financial assets was strong, there wasn’t a single platform that ticked all the right boxes. The risk, and the fear, was inhibiting people from taking the investment plunge.

The IIT Bombay alumnus knew a bit about the risk factor, and how to flip it into an opportunity. Keshre, who folded his first edtech venture Eduflix in mid-2013 after running it for close to two-and-a-half years as it failed to scale fast enough, positioned Groww as an online platform that made investment easy, fast and transparent for the DIY (do it yourself) generation. The Flipkart experience, too, came handy in designing the product and experience. “We had seen how technology and high-customer centricity disrupted the e-commerce industry,” he recalls, adding that such levers were missing in the investing space. There are only an estimated 25 million people in India who invest in stocks or mutual funds. The only way to add more, he underlines, is by making investing simple. “This is exactly what Groww does,” says Keshre.