How NoBroker turned house-hunting on its head

The proptech company recently became India's first unicorn in the space by directly connecting property owners with property seekers. But can real estate brokers, ubiquitous in India, really be eliminated from deal-making?

(L-R) Saurabh Garg, co-founder and Chief Business officer and Amit Agarwal, co-founder and Chief executive officer NoBroker.com

(L-R) Saurabh Garg, co-founder and Chief Business officer and Amit Agarwal, co-founder and Chief executive officer NoBroker.com

Image: Hemant Mishra for Forbes India

Sometime in mid-2015, when Amit Agarwal was chatting with his co-founder Akhil Gupta at NoBroker’s Bengaluru office, he noticed through the windows a mob of angry men heading towards them. He brushed it off as a regular “morcha” or protest and carried on his conversation. Minutes later, he was interrupted when that mob started banging on their office doors and breaking the glass windows. Around 50 of them—all real estate brokers—barged into the then one-year-old startup’s office, pulled the plugs on the computers and physically attacked the team. “It was a scary experience,” says Gupta, 40. “But it also marked a turning point for us because it was then that we realised that we are truly disrupting the industry.”

Set in early 2014, NoBroker, as the name implies, connects landlords, tenants, buyer and sellers directly with each other without a broker in between. It was a radical concept in India –and worldwide—at the time where brokers are seen as indispensable. Startups such as 99acres, Softbank-backed Housing.com and MagicBricks—the so-called property tech, or proptech players—were beginning to make their mark in India’s burgeoning real estate industry but none dispensed with brokers. They enlisted the latter on their portals and gave them access to customers. Similarly, in the US and China, no such broker-free proptech player existed.

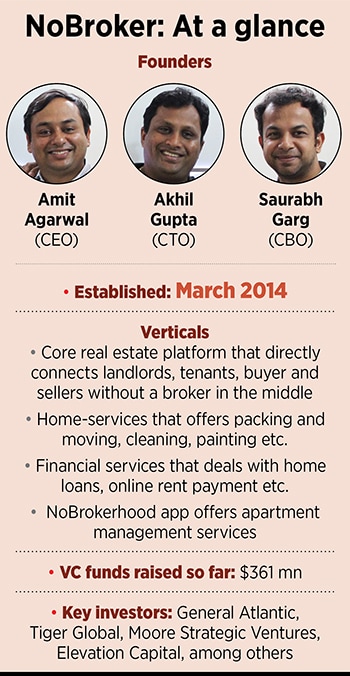

“No brokerage as a term didn’t exist before we started out. If you look at Google trends, you’ll see that the phrase started picking up only after 2014,” says Saurabh Garg, 42, also a co-founder who seeded the idea after a poor and expensive broker-led property-hunting experience in Mumbai. He then roped in Agarwal, his IIM-Ahmedabad batchmate, and Gupta, his junior from IIT-Bombay, to take the “no broker” idea to fruition.

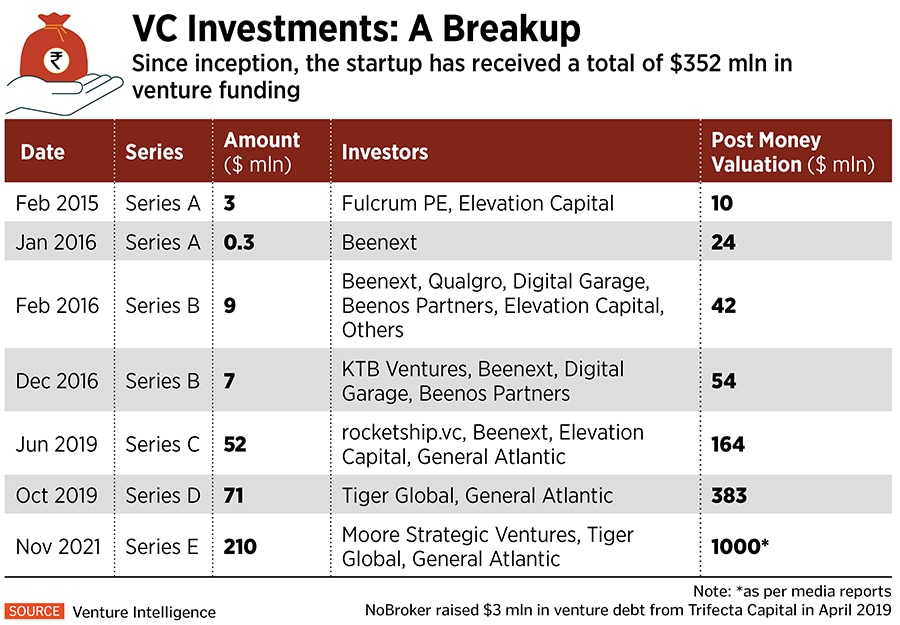

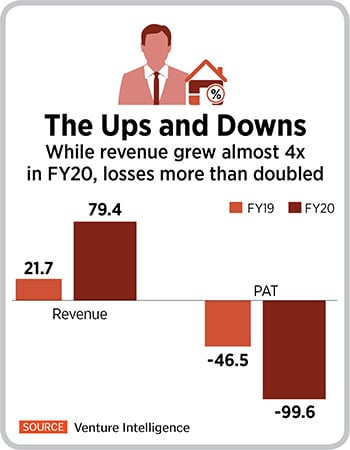

From being dismissed by multiple venture capitalists early on, NoBroker recently achieved the ultimate validation of its business model: A $210 million Series E fund raise by General Atlantic, Tiger Global and Moore Strategic Ventures in November 2021, doubled NoBroker’s valuation to a cool $1.01 billion, making it India’s first unicorn in the proptech space. NoBroker has over five lakh listings live on its portal and closes five lakh rental and sale transactions every year. Revenues stood at Rs 79.4 crore in FY20, up almost 4x over the previous year, accordng to data provider Venture Intelligence.

At the heart of NoBroker’s broker-free promise lies a C2C or consumer-to-consumer marketplace. Unlike a B2C or business-to-consumer marketplace that is easier to implement as the business side, comprising brokers in this case, brings in the supply while the startup focuses on demand generation, in a C2C model, the startup must bring in the supply as well as the demand. And, in an area like

At the heart of NoBroker’s broker-free promise lies a C2C or consumer-to-consumer marketplace. Unlike a B2C or business-to-consumer marketplace that is easier to implement as the business side, comprising brokers in this case, brings in the supply while the startup focuses on demand generation, in a C2C model, the startup must bring in the supply as well as the demand. And, in an area like  That approach involved no physical agents and no physical offices—except one in Bengaluru. It also involved closely listening to the customer. For example, when customers asked them who would draw up the rental agreements in the absence of a broker, NoBroker was quick to add that to its service offering. When customers enquired about packing and moving services after closing a deal, NoBroker added that to the mix. Today, the startup has a home-services vertical that offers services such as painting, cleaning, home interiors, besides packing and moving, all disorganised, fragmented businesses crowded with small, unbranded players. Sixty lakh customers use these services every year, says Agarwal, and the business is growing 5x year-on-year.

That approach involved no physical agents and no physical offices—except one in Bengaluru. It also involved closely listening to the customer. For example, when customers asked them who would draw up the rental agreements in the absence of a broker, NoBroker was quick to add that to its service offering. When customers enquired about packing and moving services after closing a deal, NoBroker added that to the mix. Today, the startup has a home-services vertical that offers services such as painting, cleaning, home interiors, besides packing and moving, all disorganised, fragmented businesses crowded with small, unbranded players. Sixty lakh customers use these services every year, says Agarwal, and the business is growing 5x year-on-year.