What's driving Paytm's stock price?

Although still below its IPO price of Rs2,150, the payments provider's stock has gained around 35 percent in the quarter ending June to around Rs850

Number of Soundbox machines grew to 79 lakh as of June, up from 38 lakh as of June 2022 Image: Debajyoti Chakraborty/NurPhoto via Getty Images

Number of Soundbox machines grew to 79 lakh as of June, up from 38 lakh as of June 2022 Image: Debajyoti Chakraborty/NurPhoto via Getty Images

After reporting adjusted Ebitda breakeven in the three months ending December 2022, almost a year ahead of its guidance, Paytm’s stock has been on the upswing. Ten out of 13 analysts covering the fintech major recommend a buy rating on the stock, which has gained 35 percent in the three months ending June. What’s driving this bullish sentiment?

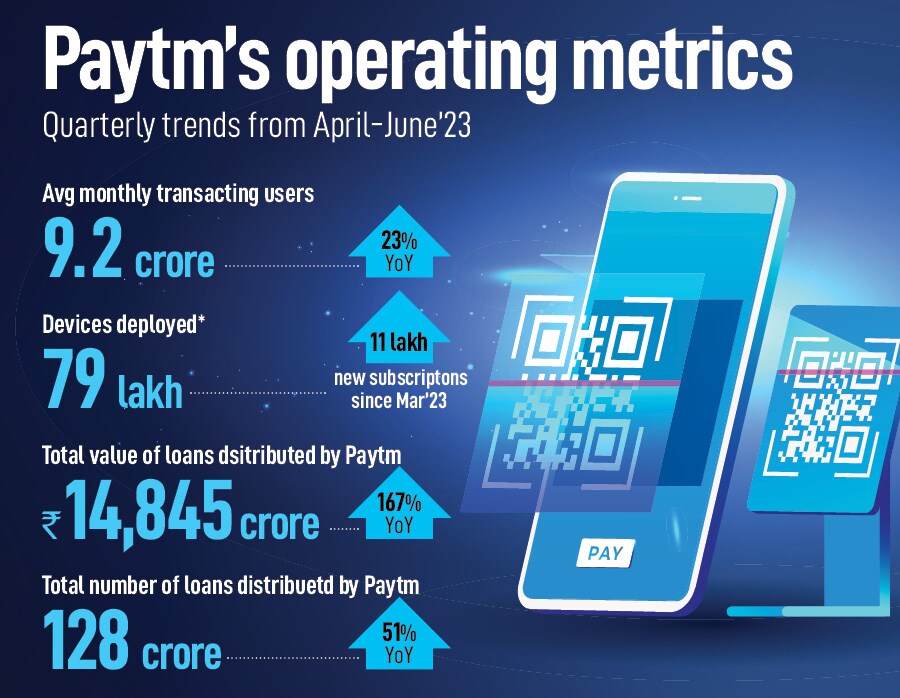

Robust growth in MTUs

First, continued expansion of consumer base, as Paytm’s monthly transacting users (MTU) grew to 9.2 crore for the three months ending June, up 23 percent compared to 7.5 crore MTUs seen in the same three-month period a year ago (YoY).Rise in number of devices deployed

Second, the number of merchants paying subscription fees for Paytm’s point-of-sale (PoS) and Soundbox machines grew to 79 lakh as of June, up from 38 lakh as of June 2022. Of the 79 lakh merchants, 11 lakh were added in the three months ending June (Q1FY24). Paytm offers a subscription-as-a-service model to its merchants, so strong adoption of its devices drives subscription revenues and high payment volumes. This in turn increases the funnel for its merchant loan distribution business.Also read: Payments banks: Why they'll be tested as they aim to become bigger & stronger