Lending to the bottom of the pyramid

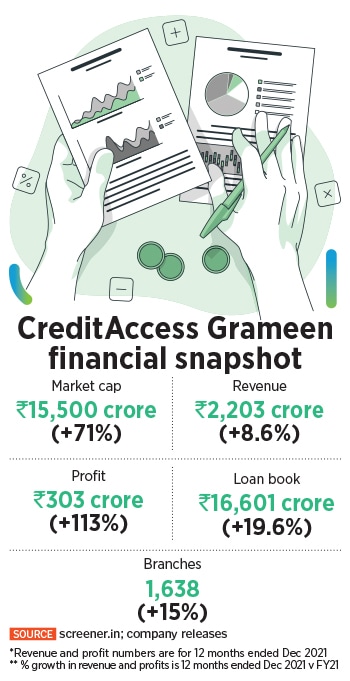

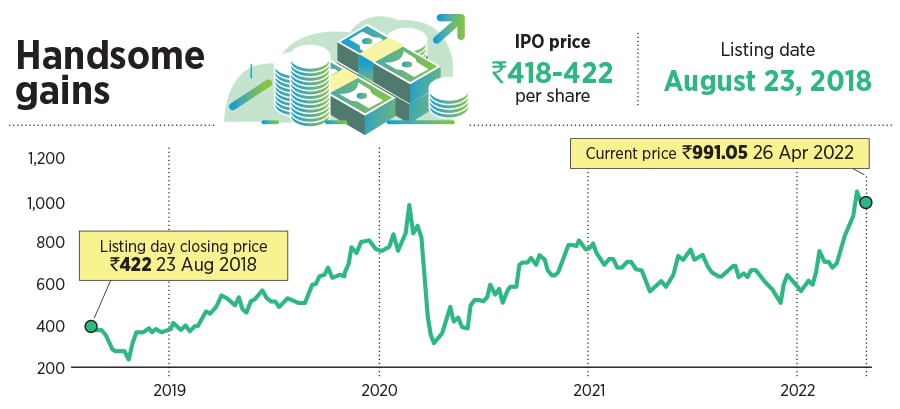

After successfully navigating the Covid-19 storm, CreditAccess Grameen is well positioned for the next leg of growth

(Left) Udaya Kumar Hebbar, managing director and CEO, and Ganesh Narayanan, deputy CEO and chief business officer of CreditAccess Grameen. Image: Selvaprakash Lakshmanan for Forbes India

(Left) Udaya Kumar Hebbar, managing director and CEO, and Ganesh Narayanan, deputy CEO and chief business officer of CreditAccess Grameen. Image: Selvaprakash Lakshmanan for Forbes India

Halfway through my interview with Udaya Kumar Hebbar, the chief executive of CreditAccess Grameen, a line I’d read while preparing for the meeting keeps ringing in my head—‘always be wary of runaway successes in the microfinance space’. I ask him why I shouldn’t be sceptical of their success.

Hebbar, who has helmed India’s largest microfinance company for the last decade, takes my question head on, saying that he welcomes the (occasional) bad time in the industry.

“In a normal time, one will never be able to differentiate between a good and bad micro finance company,” he says. “When we build a business we need to see how these businesses stand in a bad time. That is the true test.”

As he moves on to explain how CreditAccess Grameen is different (more on that later) it’s not hard to see why India’s largest microfinance company not only survived the pandemic but also emerged stronger.

Contrast this with a decade where India’s microfinance industry has been a happy hunting ground for business failures. We’ve had blow-ups as spectacular as SKS Microfinance that was once the poster boy of the industry, or regulatory action in undivided Andhra Pradesh, which overnight made it impossible for the industry to function in a state that in 2010 accounted for half of all microfinance loans in India. Credit culture in states like Assam has also taken a beating.